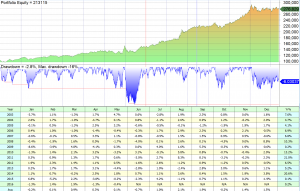

In this post we will: Take a look at a simple, momentum based, monthly rebalanced Equity/Bond portfolio consisting of two ETFs: SPY and TLT. Search for what has been the optimal dates in the month to rebalance such a portfolio. Each month we allocate to SPY and TLT. If SPY has outperformed TLT we rebalance …

SPY

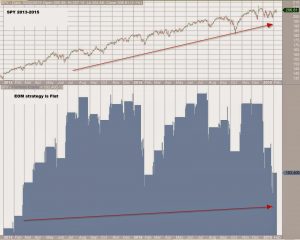

The end of the end of month strategy

Has the end of month strategy stopped working? Historically and up to 2013, equities have exhibited a positive bias during the end of the month. Here is an example of buying the SPY etf on the first down-day after the 23rd and selling on the first up-day of the next month. Trading is at the same day …

From Regime Switching to Fuzzy Logic -SP500

In the previous post I showed how one can implement “regime” switching to create a strategy that switches between a mean-reverting and a momentum sub-strategy. Can we do something similar (or better) using Fuzzy Logic? Here’s the setup: (here for some Fuzzy Logic backround) We create a basic membership function for the RSI(2) indicator: …

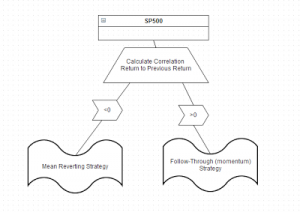

Simple Regime Switching for SP500

image from http://brucekrasting.com/ Let us consider two possible ways to trade the SP500. 1. If the index falls today, we buy tomorrow at the open. This is a “mean-reversion” strategy. 2. If the index rises today, we buy tomorrow at the open. A “follow-through” strategy. From the graphs below, we can see that neither of …

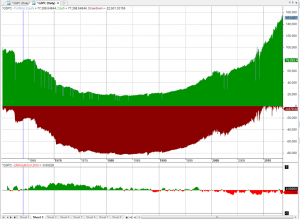

Selling Puts on Breakouts

If someone asked you to sell Puts on the SP500 and hold to expiration, when would you sell them? On a correction or a bullish breakout? This is a strategy that I came about by accident. I actually meant to do the exact opposite of what I ended up testing… I can’t say I would trade this …