In this post we will:

- Take a look at a simple, momentum based, monthly rebalanced Equity/Bond portfolio consisting of two ETFs: SPY and TLT.

- Search for what has been the optimal dates in the month to rebalance such a portfolio.

Each month we allocate to SPY and TLT.

If SPY has outperformed TLT we rebalance to 60% SPY – 40% TLT.

If TLT has outperformed SPY we rebalance to 20% SPY – 80% TLT.

For the first run we will re-balance on the first of the month and close at the last day of the month.

Now will try different combinations of entry and exit days.

We will try to purchase x days before or after the month and instead of exiting at the end of the month we will exit after y days.

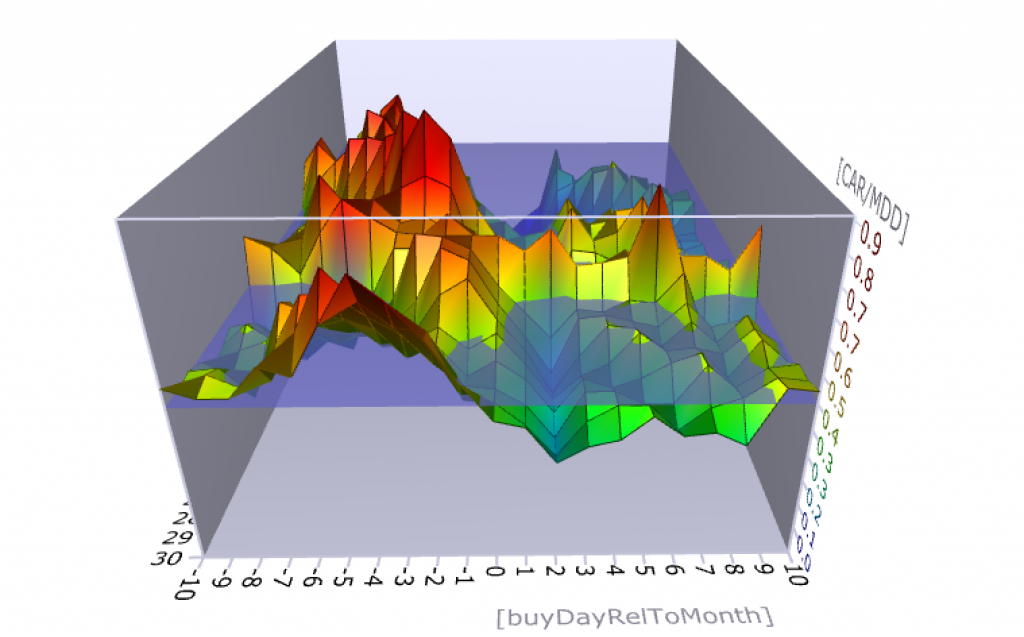

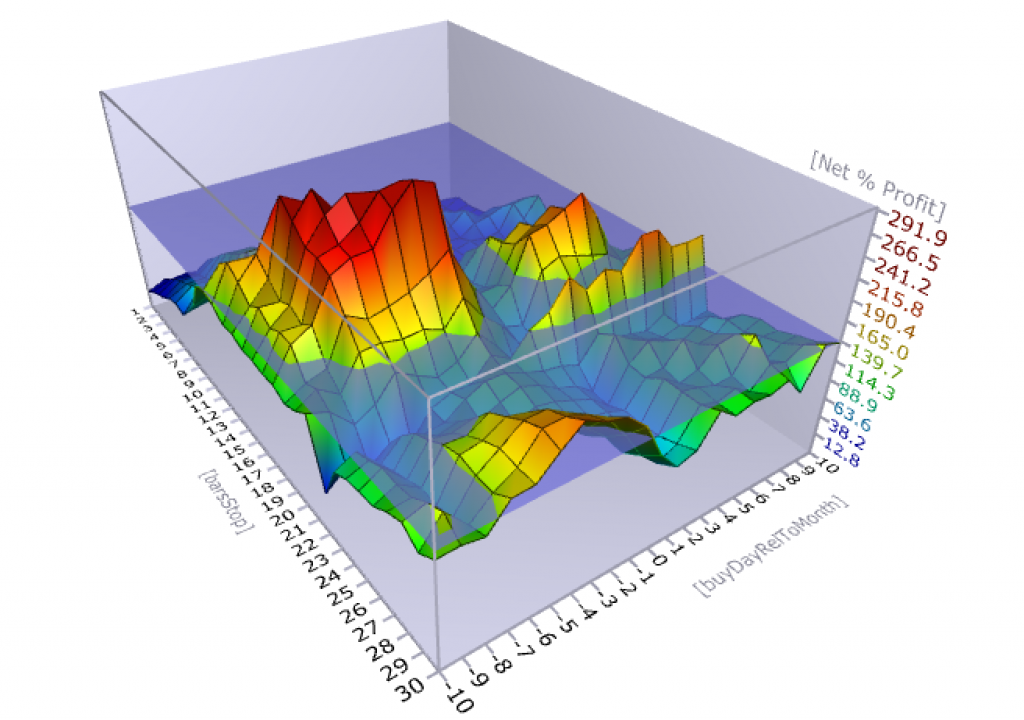

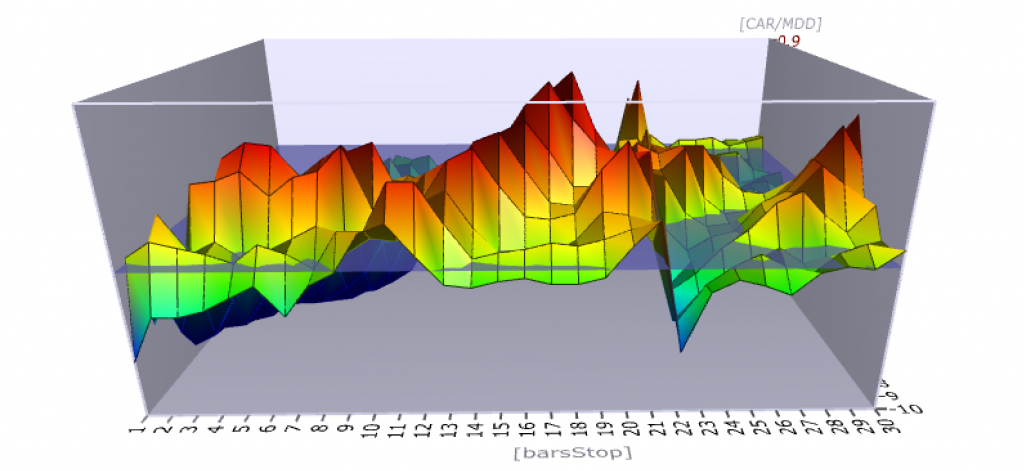

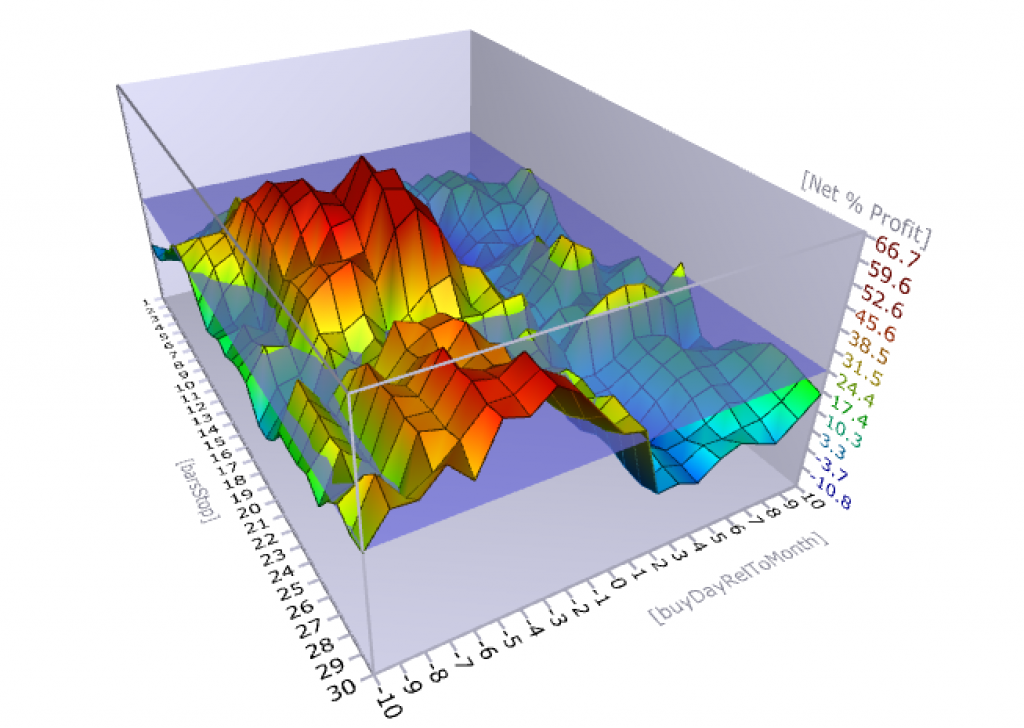

The top chart is optimized for Net Profit while the second one for annual return/max drawdown. They are similar in this case but will will use the second one.

According to the chart the best combinations have been:

Buy 3-7 days after the month and hold for around 10-18 days.

The BuyDayRefToMonth variable refers to when we buy relative to the turn of the month. For example -5 means we buy five days after the turn of the month (i.e., the 6th trading day). +5 means we buy 5 days before the month ends. The BarsnStop variable refers to how many days later we sell the positions.

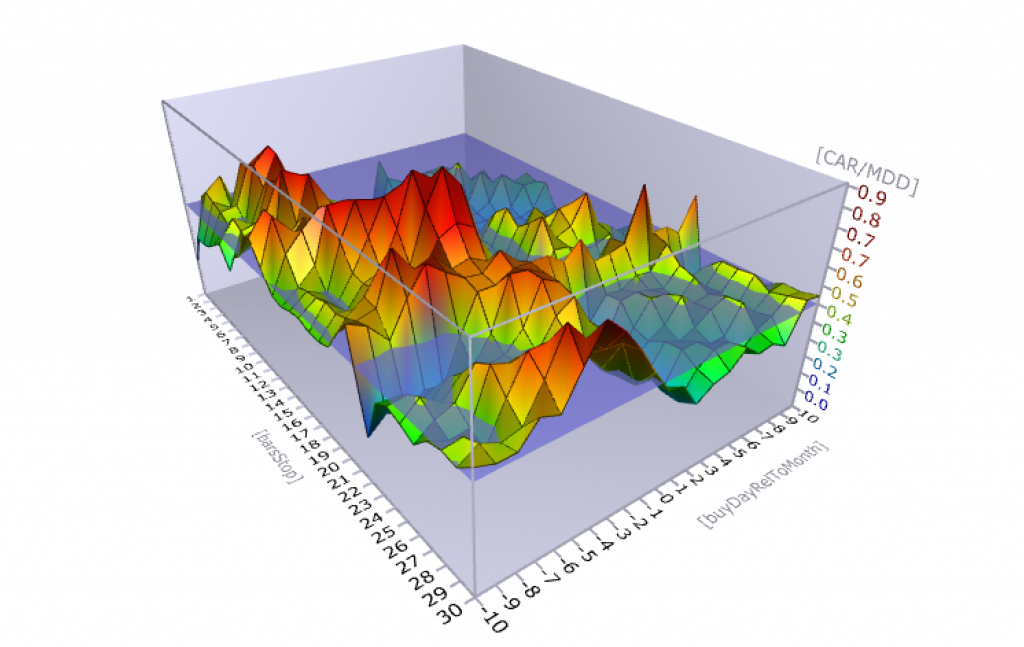

Looking at the charts more closely we see that buying after (not before) the 1st of the month gives consistently better results when set between 2 and 7 days.

How many days we hold the investment is less obvious and seems to work across the given range:

Let’s run this again but now only for 2012-May 2016:

Similar results. The only difference is that the holding times are shorter.

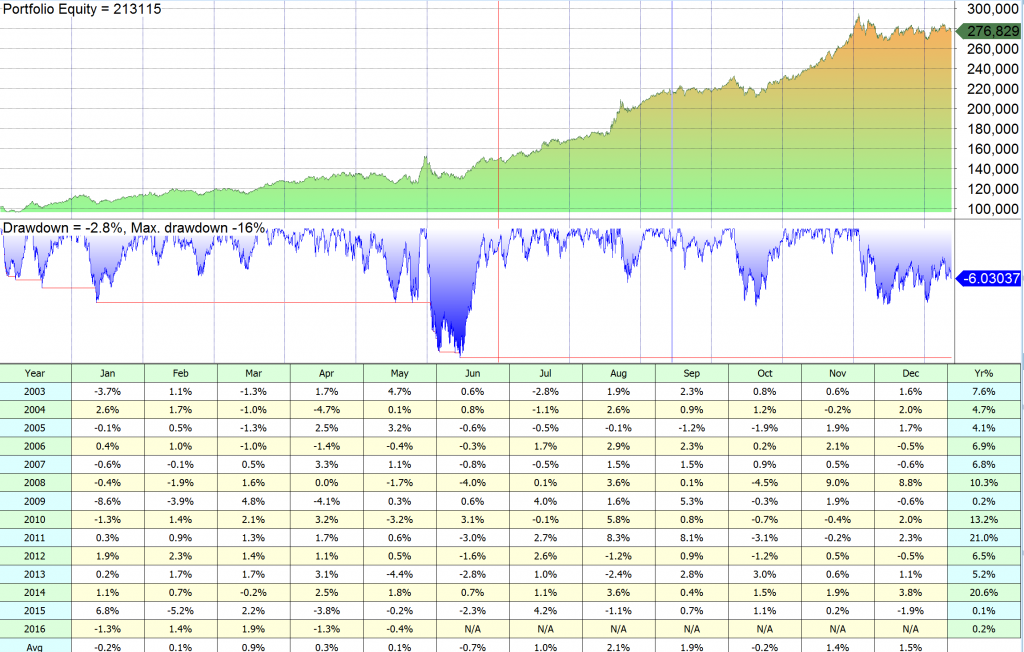

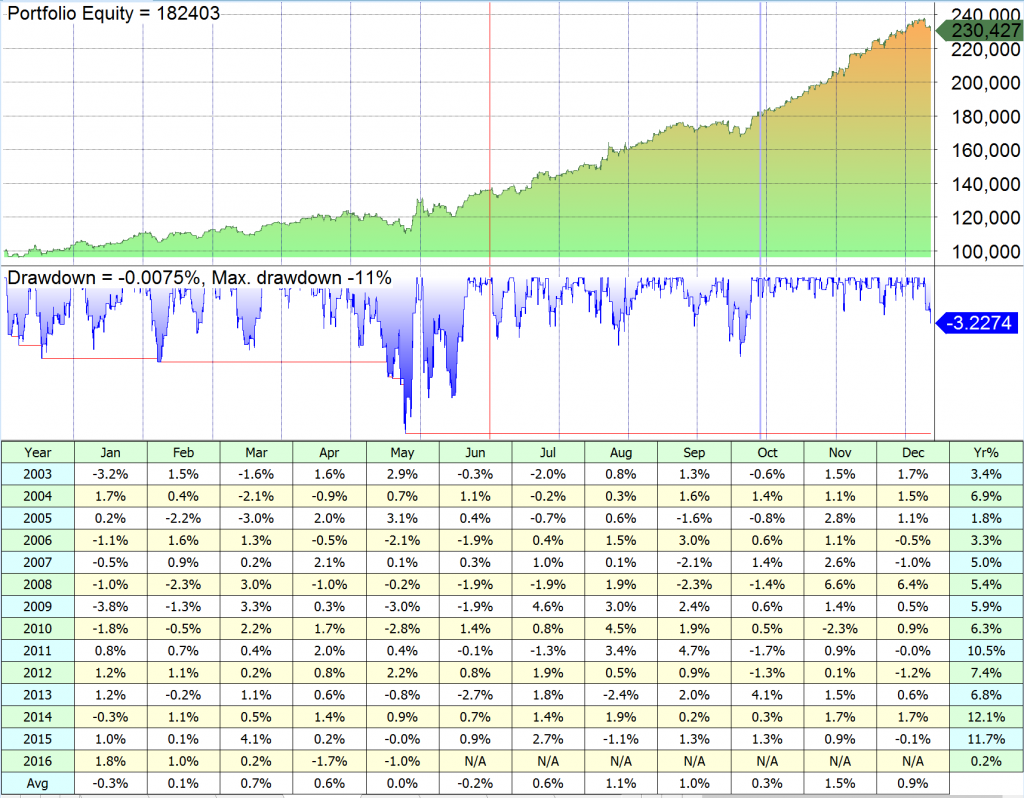

Let’s now input the optimized numbers and run the backtest. Obviously we will get something that looks good since it has been fit to the data. We buy 6 days after the month and hold 10 trading days.

Conclusion:

There are many variables that affect how we run a dynamic Equity/Bond portfolio. We optimized only two of them, namely when to rebalance relative to the turn of the month and how many days to hold the investment.

In terms of entry it was better to wait 3-6 days after the month changes to enter the trade. When it comes to this bond/equity portfolio, rebalancing late is better.

Looking for a smart bond/equity portfolio? Read about the Universal Investment Strategy @ Logical-Invest.

OMG, this blog is alive! Welcome back.

Thank you Larry. Glad someone is watching 🙂

Welcome back Sanz Prophet!!

Have been missing your posts, and like the new look & feel.