+ Strategy in a coin The Bull Bear Ethereum Set (symbol: BBE) is a strategy-in-a-coin. Instead of implementing the strategy, outlined here, you can purchase the SET, which is a standard ERC20 coin you get to keep in your wallet. Please read the strategy Whitepaper 8.82% APY on idle cash (using cDAI) When the strategy …

momentum

The Bull Bear Bitcoin Strategy at TokenSets.com

+ I will be managing the Bull Bear Bitcoin Set (symbol: BBB) . Much like an actively managed ETF, it switches between Bitcoin and Cash. There are currently zero (0%) fees*. It is ‘non-custodial’, so you own the actual underlying assets . How to follow the strategy/ buy a SET? Visit the Bull Bear Bitcoin …

From Regime Switching to Fuzzy Logic -SP500

In the previous post I showed how one can implement “regime” switching to create a strategy that switches between a mean-reverting and a momentum sub-strategy. Can we do something similar (or better) using Fuzzy Logic? Here’s the setup: (here for some Fuzzy Logic backround) We create a basic membership function for the RSI(2) indicator: …

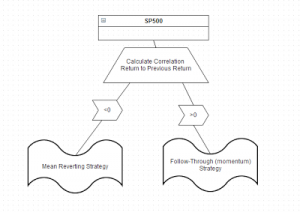

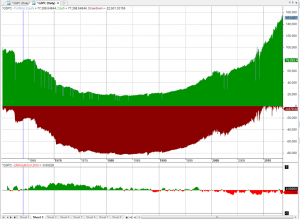

Simple Regime Switching for SP500

image from http://brucekrasting.com/ Let us consider two possible ways to trade the SP500. 1. If the index falls today, we buy tomorrow at the open. This is a “mean-reversion” strategy. 2. If the index rises today, we buy tomorrow at the open. A “follow-through” strategy. From the graphs below, we can see that neither of …