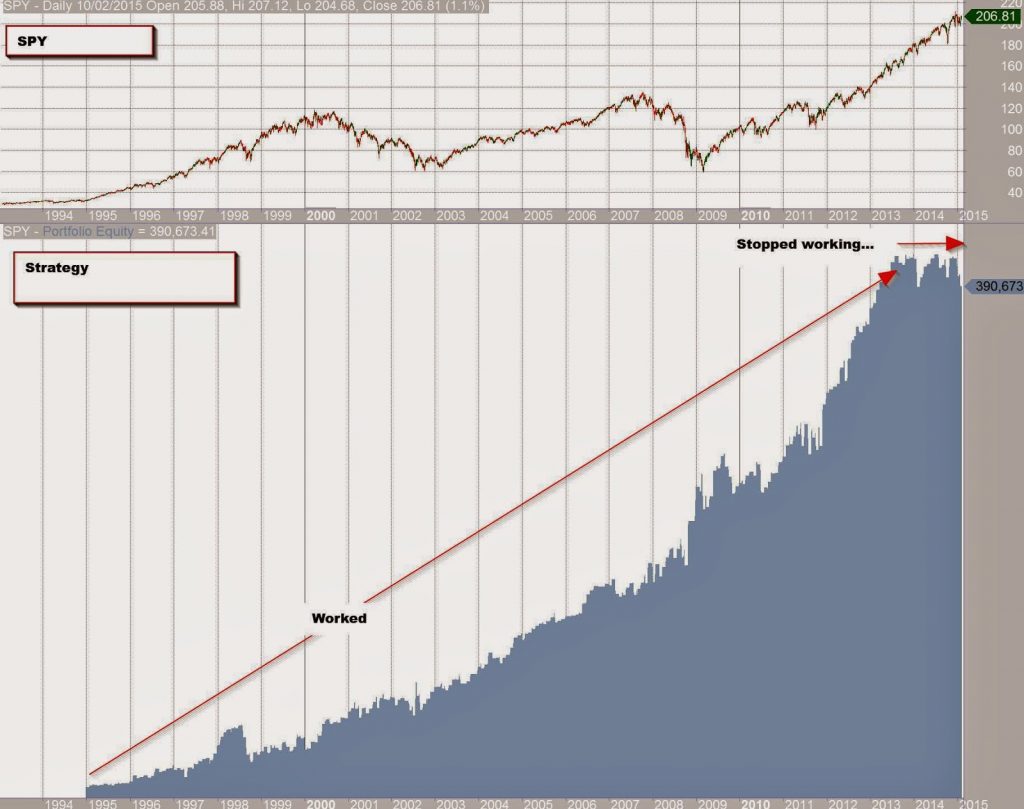

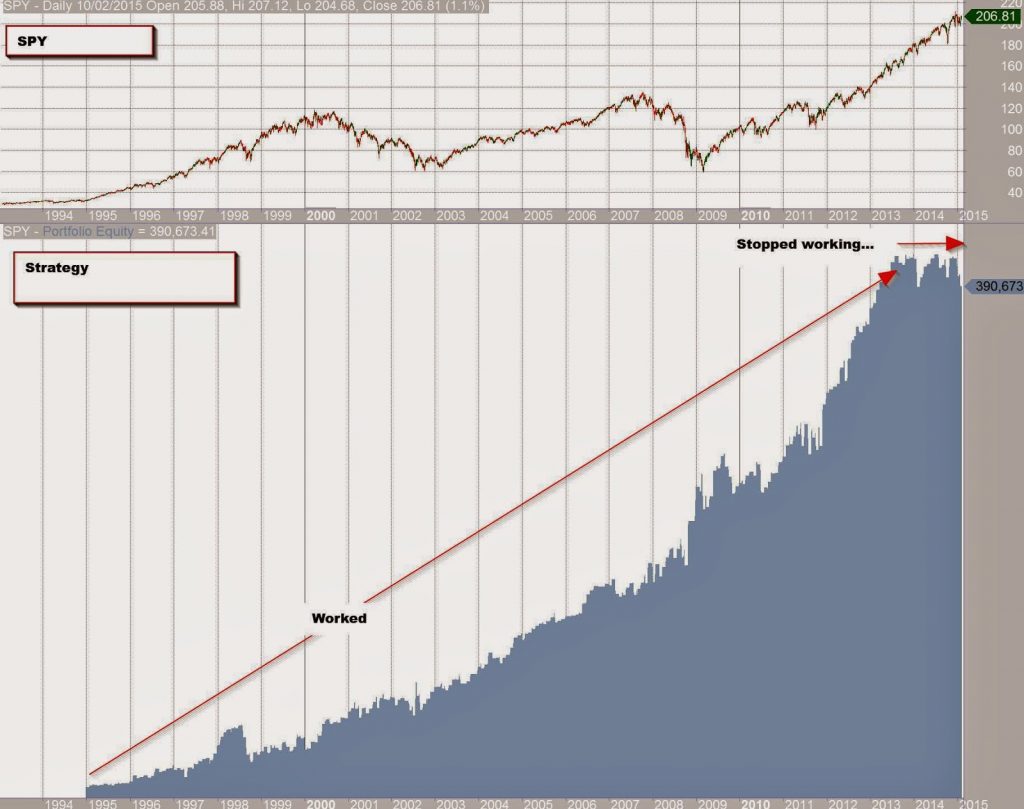

Has the end of month strategy stopped working?

Historically and up to 2013, equities have exhibited a positive bias during the end of the month.

Here is an example of buying the SPY etf on the first down-day after the 23rd and selling on the first up-day of the next month. Trading is at the same day close.

Here is an example of buying the SPY etf on the first down-day after the 23rd and selling on the first up-day of the next month. Trading is at the same day close.

This has been well documented in academic papers as well as blogs. The main reason quoted for this persistent bias has been end-of-month window dressing.

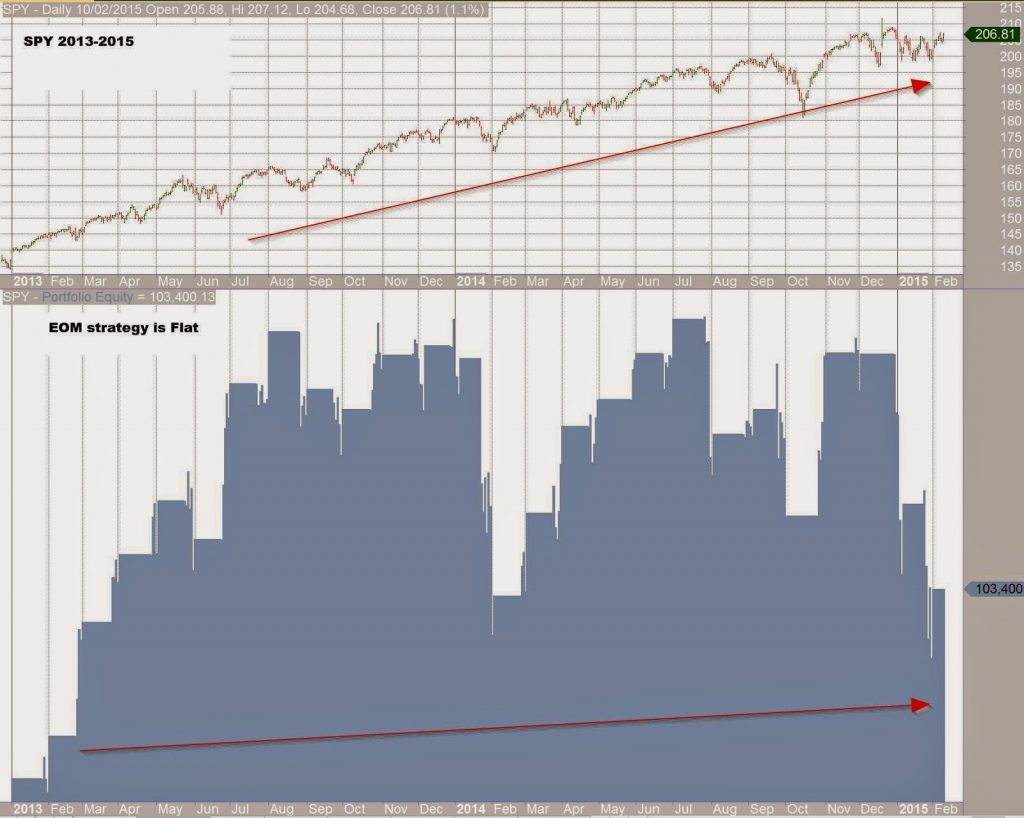

As one of my favorite author/blogger/trader, Mr. Grøtte, has also recently blogged the EOM bias is no more.

Why is this important to know?

A lot of investors re-balance monthly. The day of the re-balance used to be somewhat important as there was an EOM bias. So it was better to ‘buy’ at the end of the month rather than at the beginning of the month. As of late (2013) this is less true.

What this means in practice is that the specific timing for re-balancing monthly strategies may be less important than it used to be.

//Amibroker code:

Buy=Day()>=23 AND C<Ref(C,-1) ;//AND C>MA(C,100);

Sell= (Day()<11 AND C>Ref(C,-1));

SetTradeDelays(0,0,0,0);

slip=0.00;

BuyPrice=c+slip;

SellPrice=c-slip;

posqty=Param("nUMBER OF pOSITIONS",1,1,30,1);

SetOption("MaxOpenPositions",posqty);

PositionSize=- 98/posqty;

bars = 10; // exit after 10 bars

ApplyStop( stopTypeNBar, stopModeBars, bars, True );

Thanks. This is good. Maybe now it will starting working again.

Thanks, great article as always!

Thanks! Good article.

I'm making some tests to know if EOM bias has also changed in other markers laterly.

Looking forward to reading more. Great forum post. Much obliged. Basil