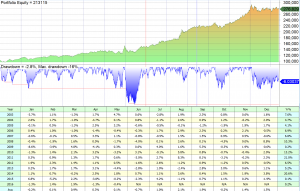

In this post we will: Take a look at a simple, momentum based, monthly rebalanced Equity/Bond portfolio consisting of two ETFs: SPY and TLT. Search for what has been the optimal dates in the month to rebalance such a portfolio. Each month we allocate to SPY and TLT. If SPY has outperformed TLT we rebalance …

Seasonal

Seasonals – SP500, Euro

Here’s the strategy: Each month we buy at the Open of the first day of the month and sell at the close of the last day of the month. Here’s the average profit loss for the S&P500 Etfs, SPY (yahoo:SPY). Data from 1993. This chart shows that for example if we bought every December @ …

Best Day to buy Bovespa – Part 2

If you bought Bovespa on Thursday and sold on Friday every week since 2003, you would be rich (if you compounded). We know this. If one was to follow such a strategy, in real-time, would it make money? In the following strategy an investor would buy at the Close of the “optimal” day that performed …

Bovespa- Best day to Buy Brazil

Best Day to Buy Brazil Index :ThursdayWorst Day to Buy Brazil Index :Friday 1993-2011 – Buy on Close of Day. Sell on Close next day.Commissions =Slippage=0. Buying On Thursday Sell next Day. $1,000 growth. —————————————— Buying on Friday. Sell next Day $ 10,000 growth. ——————–Note to myself:Best EOM buy Days: Monday or Tuesday.