This post was written to help me clarify my own personal experience trading crypto and does not constitute financial advice.

The beginning – The forced Bank holiday

Back in 2015, as Greece was sinking deeper into an economic crisis, the IMF and the European Central Bank (ECB) proposed a draconian austerity plan in return for further monetary support. In a rare instance of pure democratic enlightentment, the Greek government called on the people to decide. The national referendum was set for July 5th 2015.

61% of Greeks voted ‘no’, mainly out of national pride. It meant that Greece, a full EU member, would refuse the IMF/ECB loan, default on it’s debt and return to it’s national currency, the Darchma.

In less than a week, the ECB forced capital controls and a bank holiday across the nation. All banks closed. This forced the Greek government into overturning the referendum decision as people lost access to their savings and their pensions. Eventually the terms of the bailout were accepted.

At that time I realized I did not really ‘own’ my own money and ‘my’ bank was another a tool in the hands of some distant central bank.

The first Bitcoin Bull run – 2017-2018

Two years later I discovered Bitcoin. I started investing small amounts in the summer of 2017.

I saw Bitcoin rise from $3,000 all the way up to $20,000. That was a 600+% return in less than 6 months, something unprecedented in regular markets. I was riding the wave in awe, waking up every morning, checking my account, showing my wife in disbelief.

Then came the first series of corrections and the crash down to $6,000. If that was not enough, I had to endure more than a year of BTC slowly bleeding another 50% of it’s value down to $3000.

Needless to say my experience with alt-coins such as ETH (an alt-coin back then) and XRP was even worse. ETH was around $200 at the summer of 2017. It reached $1400 before crashing to $300 and eventually $89. By the end of 2018, most altcoins in my account had almost zero value.

My conclusion from the 2017 market where:

- Crypto is extremely volatile and you will loose at least 60% trading it. Alt-coins, including ETH should be expected to have 70-90% drawdowns. It sounds obvious but it is not during a bull market. That’s why everyone on more than 3x leverage eventually gets liquidated.

- There are 2 stages to a crypto winter:

a. First, a few consecutive price crashes that deleverage the market and take back the gains of late participants. At this stage investors are still optimistic and want to add coins at these lower prices.

b. The ‘slow death’, a prolonged period where nothing is going on in the space, the coins never rebound just slowly trend to zero and most investors are just stuck with coins they don’t feel it’s worth selling. The psychology is to stop looking at the account(s) and to just forget about it all. - Almost all alts go to zero. If you want to HODL in a bear market keep it at least in BTC or ETH.

In hindsight, trading crypto seems very easy in the beginning but it is not. It is a psychological rollercoaster and an ego crushing experience. The crypto market can produce life-changing gains. It will boost your ego and make you feel you are a genius that makes in one week what other people make during a year. When the crypto winter arrives it comes in such a way that it almost impossible to exit the market.

Psychology is the problem:

a. Gains seem like ‘free’ money so you fell like gambling it all until you either win big or loose it all.

b. You become impartial and you start connecting your identity (‘smart’, ‘genius trader’, etc) to the fact that you are making money. Loosing affects that identity, crushes the ego. You become impartial and have trouble realizing the losses and exiting the market.

Holding through 2018-2019

Believing in the fundamentals of Bitcoin, I held and added through the 2018-2019 bear market. I lost a lot of what I made but came out with a small profit and a bigger investment into 2019.

Since I had 10+ years experiencing developing and trading quantitative strategies, I understood that the only way for me to trade the crypto market was rules-based Investing. I researched, backtested and created my own quantitative strategies that would get me in and out of crypto better that I could.

Starting 2020 with TokenSets

At that time, TokenSets already created a decentralized, rules-based fund that invested based on a long term moving average. It was a step in the right direction. When they allowed ‘social traders’ (ie, managers) to join, I created two funds. The BullBear Bitcoin (BBB) fund and later the BullBear Ethereum (BBE) fund.

At the time I wrote this as to what is the advantage of following the strategy:

The main advantage is controlling downside risk. Compared to holding Bitcoin the strategy has cut risk to less than half, in backtests. You also get rules-based entries and exits so that will remove your emotional decision process on when to enter or exit your bitcoin position

The 2020 run

The BBB strategy was launched in January 16 2020 with Bitcoin at $8,710.

The BBE strategy was launched February 1st 2020, with ETH at $183.

Both strategies skipped the March 2020 crash and went to cash. They went on to perform as intended, riding the bull market while going to cash when there was trouble.

As the bull market took off, it became evident that running a ‘conservative’ strategy was a problem. So while BBE was posting 300% gains, other long-only strategies posted 400%-500%+ since they never exited the market and used more volatile coins, namely LINK , to ride the bull run.

The lesson here became that if you wanted to attract money to your fund, you had to outperform ETH. If you underperformed, investors would leave and go to the ‘winner’ funds. In a straight bull market, the most reckless risk-taker wins. Anyone using a strategy that protected on the downside was underperforming and people had no incentive to invest.

2021, DEFI and the rise of the Farmers

As ETH shot from $300 to $3000 and DEFI protocols became popular, no-one was paying attention to momentum or trend-following. it all became about farming, staking and leverage and meme coins. The ‘degen ape’ became a thing and everyone was posting ways to earn 100%+ APY’s providing liquidity on new protocols. Dogcoin, foodcoins and other alts were posting 3 figure returns… Everyone was making so much money and somehow everyone was a winner. Then came the NFT’s and that pretty much signaled the excess as millions were spent on jpgs. And still the market kept going….

It would be unfair to say that one could time the top. The signs were there but the they lasted for a long time while the market kept rising. Some of the signs were:

- Everyone was making insane amounts of money. Everyone, from 14 year old NFT gamers to large funds. There is rarely a market that everyone is a winner.

- NFTs were being sold for amounts that defied logic or common sense.

- APY numbers were insane compared to TradeFi.

- The richest real estate buyers in NYC were crypto founders.

- Arrogance grew abundant both from others and from within.

2022 Exiting the market

Although I had to stop running my public funds due to reduced AUM and high rebalancing ETH fees, I continued running my strategies in private.

I became used to the bull market and decided to ‘diversify’ my profits into other strategies. One was a simple ‘Buy and Hold’. I set aside some money that was very secure and not to be traded, as emergency money. The second was delta-neutral leveraged farming. The third was earning some % on various protocols (including Celcius). I also experimented with the Terra ecosystem way before it became popular, using the Mirror protocol to buy and ‘farm’ stock.

So what happened?

- My original strategies whipsawed for a while and eventually got me out around April. Around $32,000 for Bitcoin and $2,900 for ETH. That worked as intended.

- My Buy and Hold portion is still long (BTC only). This has been my biggest mistake as I should have hedged it according to my strategy. Now I have to worry and fear as the market keeps fluctuating.

- My leveraged farming was stopped early on, before the June crash, as it became difficult to hedge very big moves. For reference I first farmed leveraged BNB at PancakeSwap while being short BNB futures on a CEX and subsequently leveraged AVAX at Alpha Finance while being short AVAX futures. Always with less than 5% of my account size per protocol and assuming I could loose 100% due to hacks, etc.

- I closed my Celcius account (which I had since 2019) a few months before it collapsed. Excessive marketing and outrageous bonuses for depositing new money were the first indicators. But the main reason was an incident with Celcius support. A few months ago, I decided to move my CEL balance out of my account so I could sell but got locked out (for security reasons since I used a VPN). It took me 2 weeks to unlock the account and had to deal with a Cyprus(?)-based support agent who was being quite evasive. That was a red flag and got me out.

- My Terra/Mirror experiments stopped almost a year ago. I was tempted by the 20% interest ‘savings account’ but I always thought it was unsustainable especially given the popularity it attained.

Strategy Performance

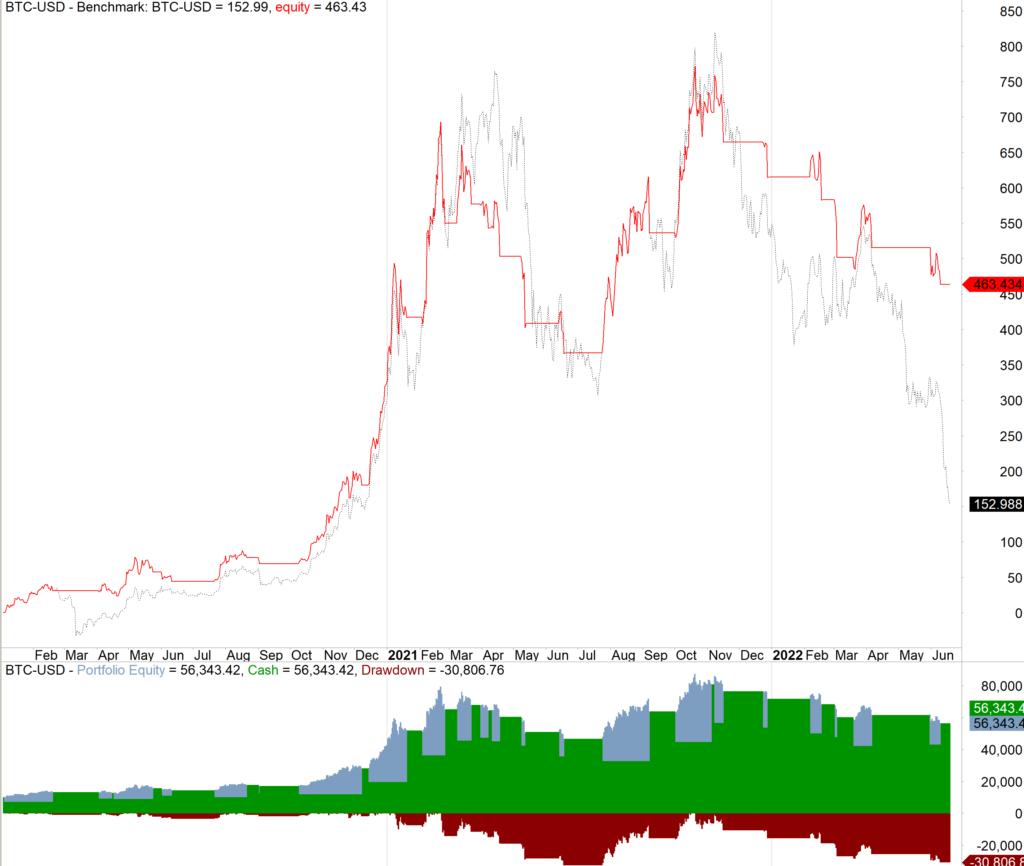

Below is the equity curve from the backtest of the BBB strategy at 1x leverage. The strategy did ok and protected capital (460% vs 152% buy-and-Hold).

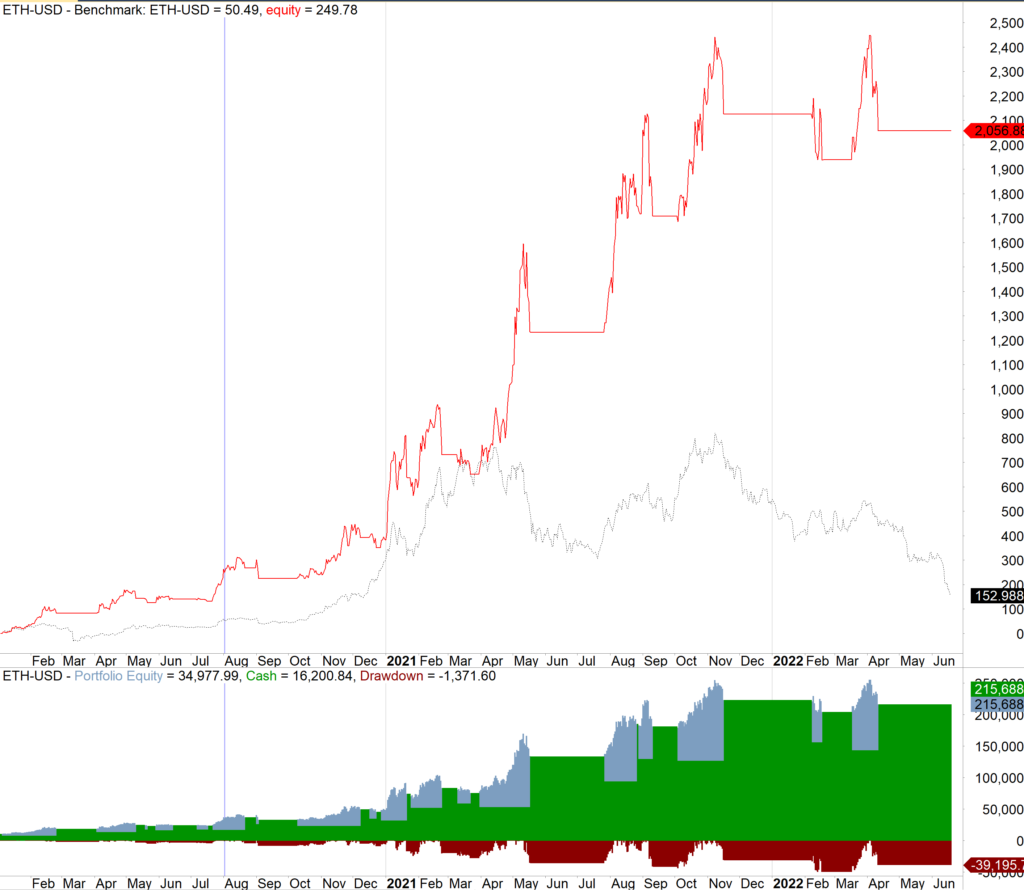

And here is is the equity curve for the BBE (Ethereum) strategy at 1x leverage. This fared better.

More strategy details on another post.

Leave a Reply