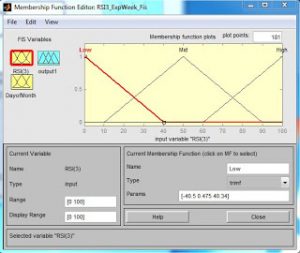

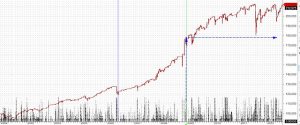

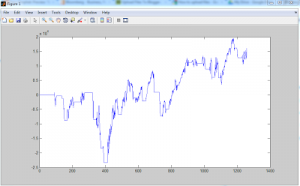

Backtesting Fuzzy Logic in Amibroker In pt.1 we backtested a “fuzzified” trading strategy in Matlab (read part 1): Buy when RSI(3) is Low and it’s before Expiration week. Although it was easy to develop this fuzzy model in Matlab, due to the intuitive GUI, it is difficult to get meaningful backtest results, visual signals, statistics …

Read moreThe case for Fuzzy Logic in Trading – Pt. 2: Amibroker