I wrote an article on how to automate the process of updating quotes, updating multiple trading strategies and e-mailing next day signals form the cloud to our own e-mail boxes. This time I am using QuantShare as the trading software and an Amazon EC2 micro instance as the host cloud. You can read the article …

Stock

Uncover Hidden Market Relationships Using Fuzzy Logic

In the previous posts (pt1, pt.2, pt.3) we talked a bit about how to take various indicators and fuzzify them. Now I will show how we can quickly test for relationships in indicators.So the question is: Can we only use RSI(3) and RSI(14) (short term and medium term Relative Strength Index) to trade the S&P500?So …

Read moreUncover Hidden Market Relationships Using Fuzzy Logic

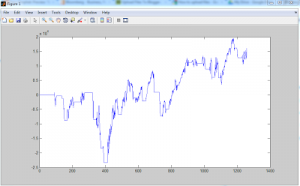

Matlab for Amibroker Users – Backtesting Functions for Matlab

The point of this post is to provide some basic functions to non professional Matlab users that may help backtest a simple long only system the way Amibroker (and most other software) backtest. If you are an Amibroker user you are used to something this easy: sma9=ma(close,9); sma21=ma(close,21); buy=Cross(sma9,sma21); sell=Cross(sma21,sma9); Wish you could do …

Read moreMatlab for Amibroker Users – Backtesting Functions for Matlab

Basic Backtest Function for Matlab

[pnl,pnlvector, sh]= backtestlongAmount(data,signal,buyprice,delay,amount$$); This is a very basic function for backtesting a strategy in Matlab.All you need is a vector with 1s for Buy, -1’s for Sell and 0’s for Hold. To use it we need1. A vector of prices,i.e. SPY close prices2. Signal: A vector of 1 for BUY, -1 for SELL and 0 …