I am faced with the following dilemma: 1. I believe in rules and strategy-based trading. I believe one must not deviate from the “rules”. 2. I can “see” risks that are not incorporated into my model(s). Let me put this in context. From a quant point of view (at least a simple, price-based quant model) a …

Archives for February 2013

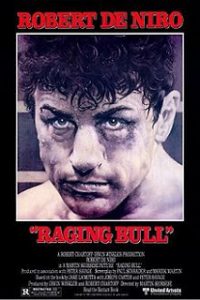

Raging Bull

It seems that most of the strategies that are in the public sphere, are consciously or unconsciously trying to prevent the large 2007-2009 draw-down. From simple to complex Tactical Allocation Systems, to mean-reverting strategies, to volatility based strategies, pairs strategies, etc. They all avoid (in hindsight) the biggest market crash that most of us have experienced. But what happens …