On January 2020 I posted a proposal for combining the Permanent Portfolio with a small 5% allocation to Bitcoin. The main argument was that by risking 5% of the portfolio we could almost double returns.

- What would happen if you took $5,000 out of your $100,000 permanent portfolio and allocated it to Bitcoin?

- From 3.6% annual to 15% annual returns?

Fast forward – 2 years later

Two years later I am revisiting the portfolio to see how it did. The rules were very simple and easy for anyone to reproduce. The so called BPP (Bitcoin Permanent Portfolio) allocated:

- 25% to SPY

- 25% to TLT

- 25% to GLD

- 5% to Bitcoin

Real test forward 2020-2022

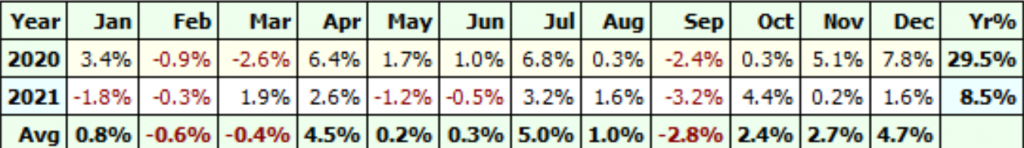

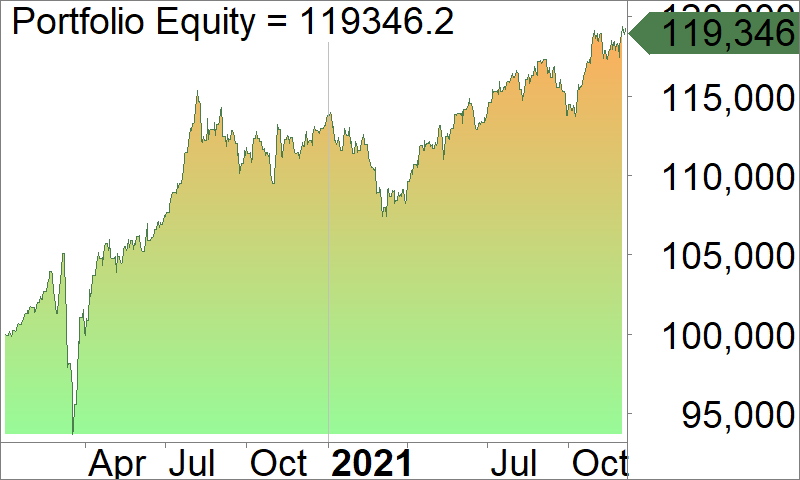

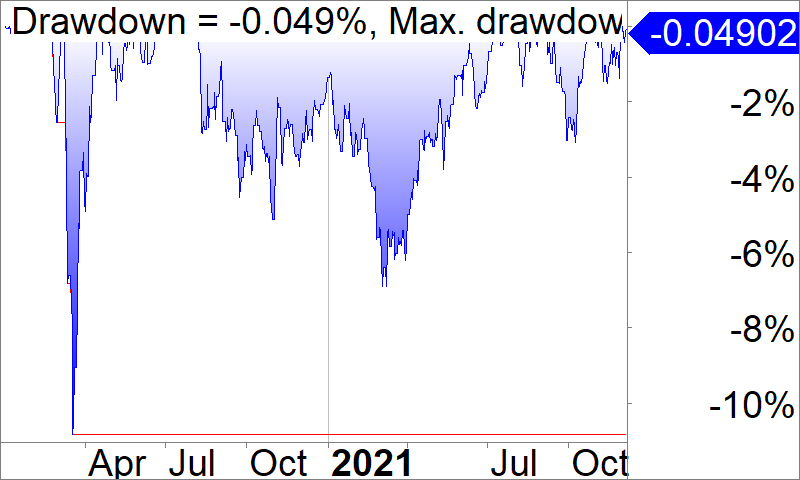

The BPP returns from January 1 2020 until January 1 2022 are

Profit : 40.5%

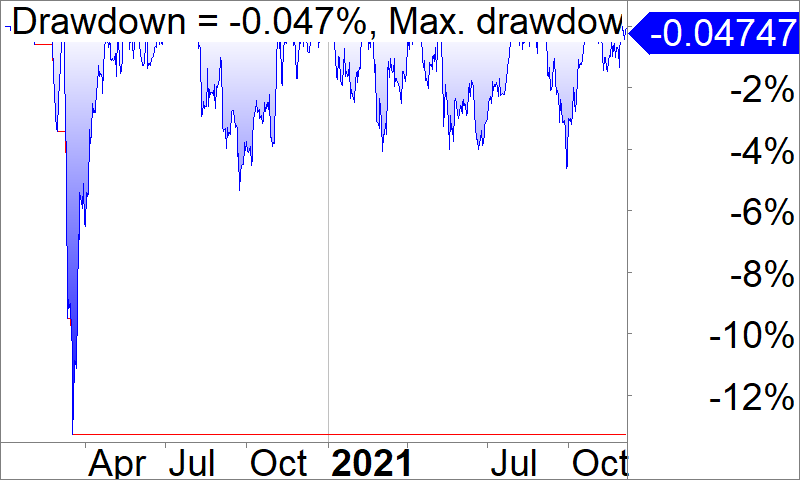

Maximum Drawdown: 13.28%

Sharpe: 1.40

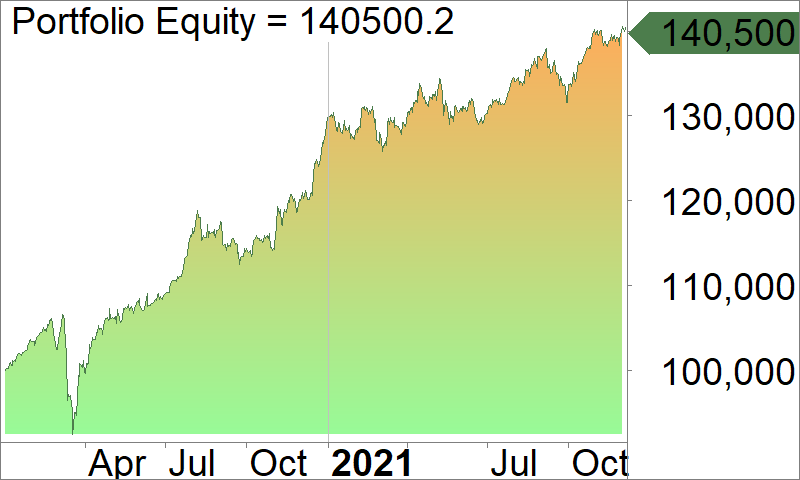

Equity assuming $100,000 starting capital

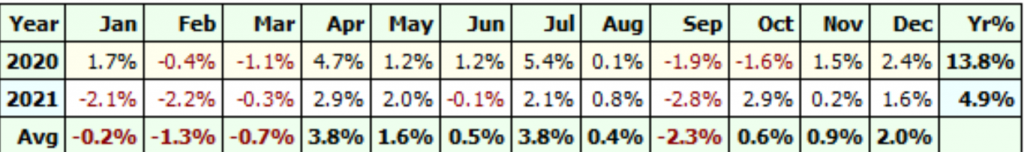

The traditional Permanent Portfolio for the same period:

Profit : 19.35%

Maximum Drawdown: 10.13%

Sharpe: 0.85

Conclusion

If you allocated just 5% of your Permanent Portfolio tp Bitcoin you would indeed double your returns while keeping a similar risk profile.

Leave a Reply