Thanks to the wonderful world of cryptocurrencies, Decentralized Finance (DeFi) and Mirror finance this is possible, at least at the time of writing.

Goal

Deploy $20,000 in capital and target an income of $1000 per month.

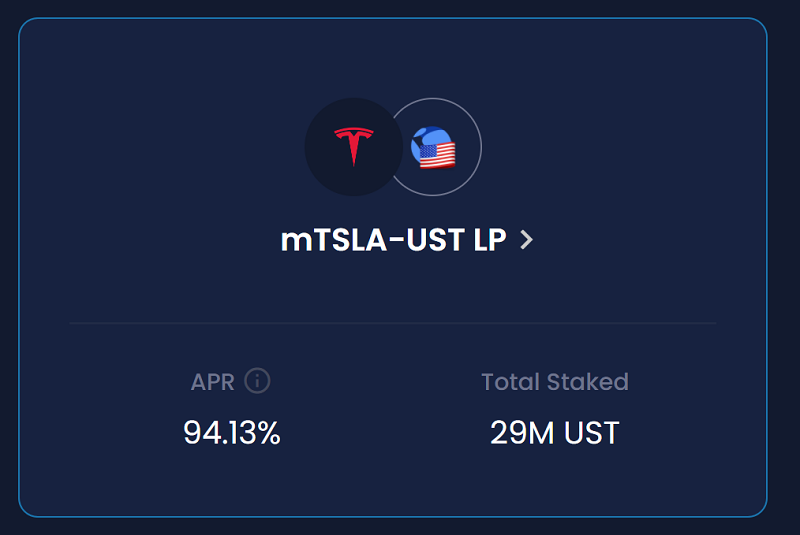

Using the UST and mTSLA pool

Although it is possible to do this in the Terra or the Ethereum blockchain, this example uses the Binance Smart Chain.

We buy $10,000 of UST. UST is a stable coin (TerraUSD) tracking USD.

We also buy $10,000 in mTSLA. mTSLA is a mirror asset that tracks the price of the TSLA stock.

We then submit the two assets to a liquidity pool (LP). In our case it is the UST-mTSLA pool and the provider is PancakeSwap.

What is a liquidity pool? An LP is an automated market-maker that provides liquidity to a particular market. In our case, every time someone executes a trade between UST and mTSLA, the LP providers get a cut of the trading fees, usually around 0.25% per trade. Since we are part of that pool we earn fees proportional to the capital we commit.

When the transaction is finalized and recorded on the blockchain we end up with an LP token.

Additional staking

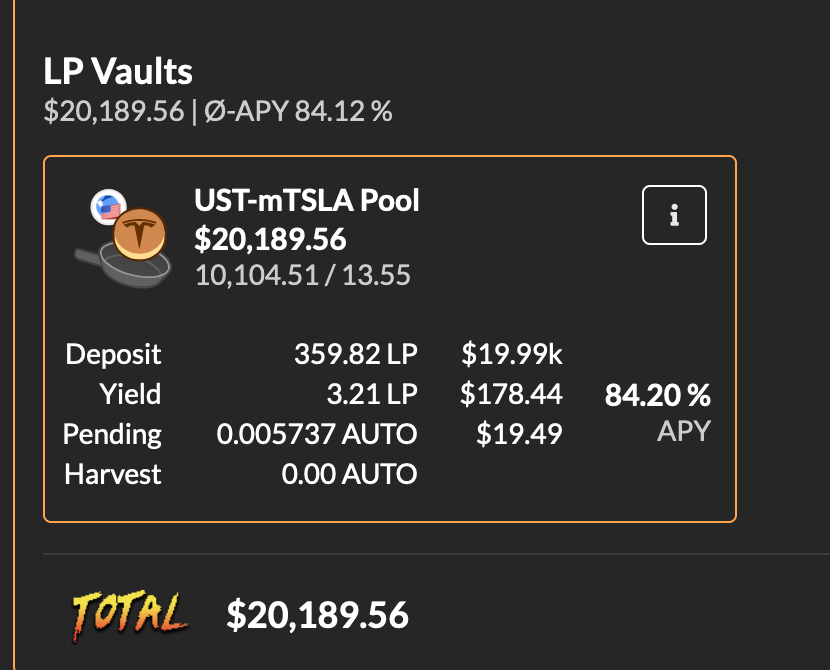

To complicate things further this LP Token is ‘staked’ in another protocol called Autofarm. This protocol gives out an additional ~10% APY for the service of staking capital as well by auto-reinvesting interest.

At the end of the day, the setup yields around 84% APY or 0.18% per day, which comes out to $36/day or $1080/month. Again, by risking $20,000 we get an income of $1080.

What are the risks

Two types: Protocol risk and equity risk:

The equity risk is exposure to $10,000 worth of TSLA stock volatility.

The risk that the smart contracts that comprise the protocols break or get hacked and end up losing user funds. The protocols here are:

- Mirror protocol (mTSLA)

- TerraUSD stablecoin protocol (UST)

- Pancake Swap protocol (The liquidity pool provider)

- Autofarm protocol

- Binance Smart Chain (which has an added risk due to being a centralized blockchain).

- Coin price risk as the yield is collected in LP Tokens and AUTO Tokens, not is USD.

Does it work?

Of course, one needs to get back to USD (or at least ETH or BTC) to be sure. For now the funds are still locked in the pool. So far the yields are as advertised:

What you see above the initial deposit 359.82 LP Tokens and the yield 6 day later of $178.44 + $19.49.

For anyone wondering why we should bother with TSLA, the answer is we don’t have to. We can hedge by shorting $10,000 TSLA on our ‘normal’ broker, be market neutral and just collect the yield.

Welcome to the strange world of DeFi!

Disclaimer:

This is not a recommendation or guide on how to invest. It is an introduction to what is happening in the world of decentralized finance describing an experiment and does not reflect normal investment models and strategy rules. Many of the protocols mentioned are in ‘Beta’ status and have extensive disclaimers about loss of funds. Loss of capital is possible and very likely. This is a young, complex finance sector, meant for experimentation and not suited for risk-averse investors. We by no means recommend investing real money in any mentioned protocol or smart contract unless you research, understand and accept the risks involved.

Are you still able to submit UST-mTSLA to a LP on PancakeSwap? I’m not seeing it listed. The APR’s on the short side on terra.mirror.finance look much higher- have you looked at shorting instead of going long?

I have switched to UST-mCOIN. Thanks for the heads up on the short side APR’s. Maybe there’s an opportunity there as well.