| Name of Fund (TokenSet) | Inception Date | Inception (USD) | Inception vs Base currency | Drawdown (vs HODL) |

| BullBearBitcoin Fund | January 16th 2020 | +40% | +3.6% (vs ETH) | -20% ( -52% ) |

| BullBearEthereum Fund | February 1st 2020 | +112% | + 3.4% (vs BTC) | -25% ( -61%) |

The point of this review is to evaluate if the BullBear Tokensets are performing as expected and have the market characteristics that we expect.

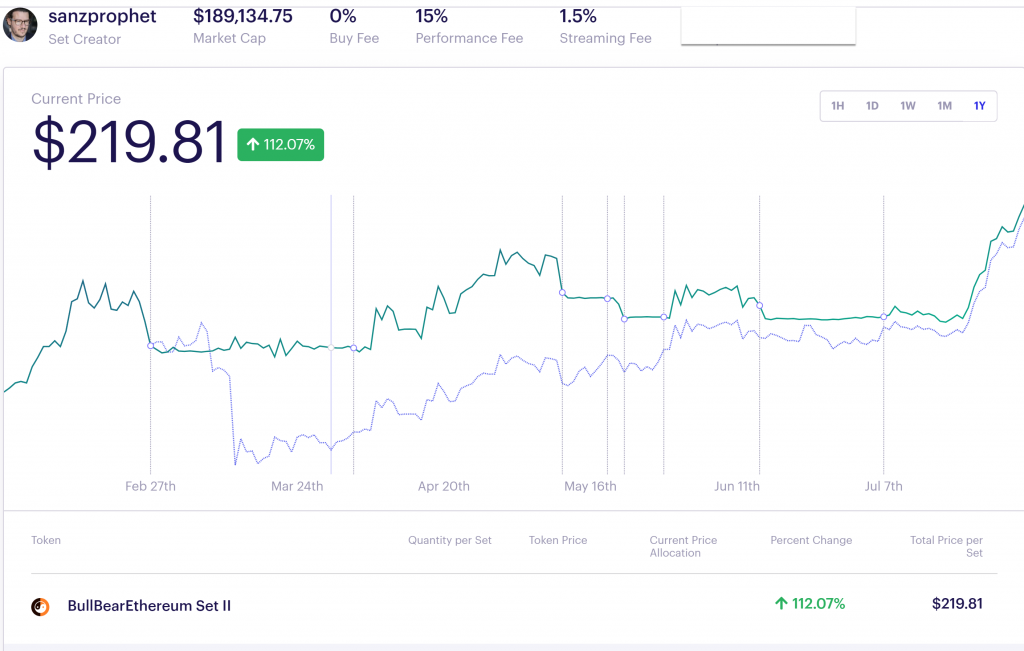

1. BullBear Ethereum Set (BEE)

Below you can see the fund details from TokenSets. This represents real returns net of slippage, performance and other fees.

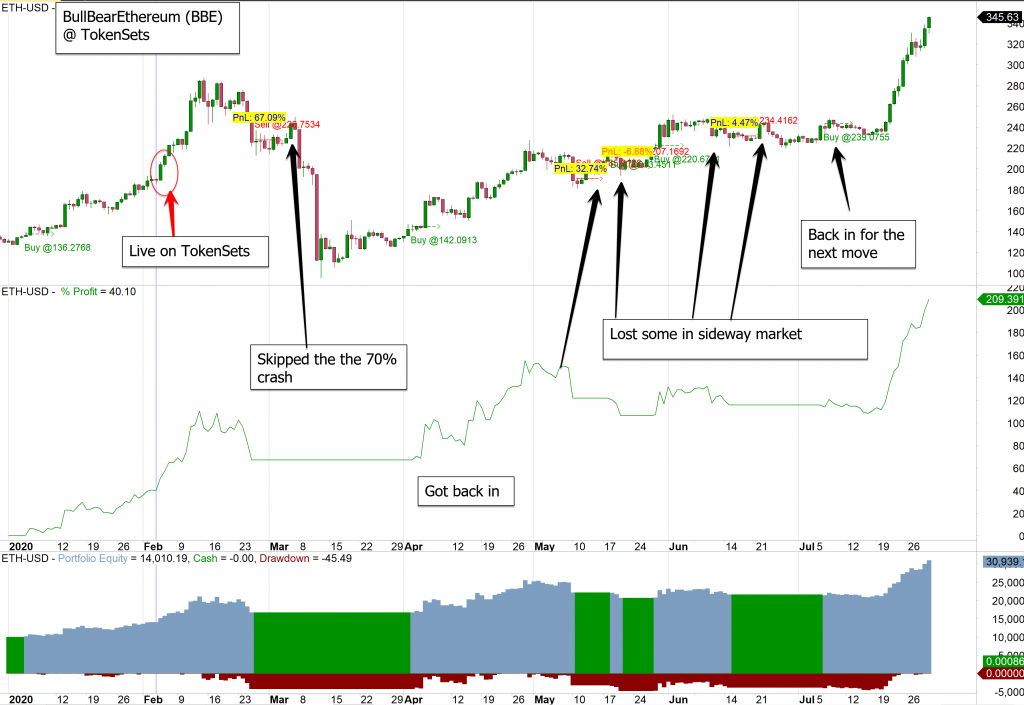

Reality vs Backtest

Below, in the middle pane, you can see the backtest equity of the strategy before and after February 2nd. The third pane is also the equity curve (capital) of the fund but also shows when the fund in in cash (green area) and when in ETH.

So let’s take a look at what happened during the past 6 months:

- The fund went live on TokenSets on February 2nd. The model was long ETH since January so it started with 100% allocated to ETH.

- Around March it exited and avoided the 70% ETH crash.

- It re-entered in April. It then traded through a side-ways market, where the strategy is bound to loose trying to enter on up movements and exiting on down-movements.

- Finally ETH did a substantial move, which was caught by the fund as it went to ETH.

We are now in a bullish move that hopefully will take us much higher before the market shows weakness again.

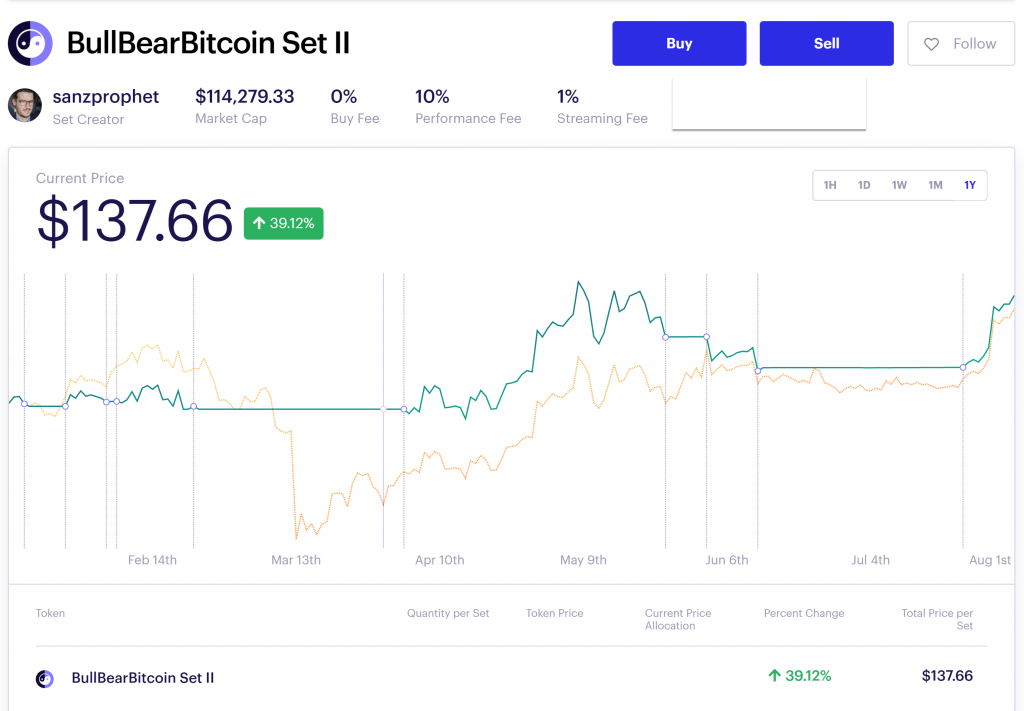

2. The Bull Bear Bitcoin Set (BBB)

Bitcoin did not have the run Ethereum enjoyed so returns are lower. Again as you can see from the equity below, BBB managed to avoid the March liquidity crash and catch this last move up by Bitcoin.

Conclusion

Both strategies are reacting as expected. Both strategies priority is to dampen large losses and participate in any large upside moves.

Keep in mind that compared to other strategies on TokenSets, given a bullish market, they will under-perform. Crypto-to-crypto strategies (BTC/ETH) and LINK based strategies will always perform better.

When the bullish move is over (and I hope it is not soon) the question will arise: When do I take my profits? Then strategies such as BTC/ETH or LINK/ETH will have a hard time keeping profits and will increasingly become similar to a buy and HODL strategy.

I´ve found network fees extremely high when buying at tokensets.

Is possible to buy them somewhere elsa like p2p or at any dex?

Hello Augusto,

There are some Tokensets available on Balancer but I am not sure about liquidity and spreads. Fees should be lower. Make sure to buy/sell using the same asset that the Set is in so you pay less fees. So if BBB is 100% USDC, use USDC to buy, rather than ETH which will force an additional exchange (ETH–>USDC)