The new updated TokenSets are live. Interest bearing ‘cash’ is enabled.

Not sure what I am talking about? See what are TokenSets.

The new Bull Bear Sets will :

- Monitors the market and will participate in any substantial Bull market.

- Monitor the markets and exit if the crypto market enters a sustained bear market.

- Earn interest on cash while waiting at rates much higher than banks.

Did the BB Sets protect during the coronavirus crash?

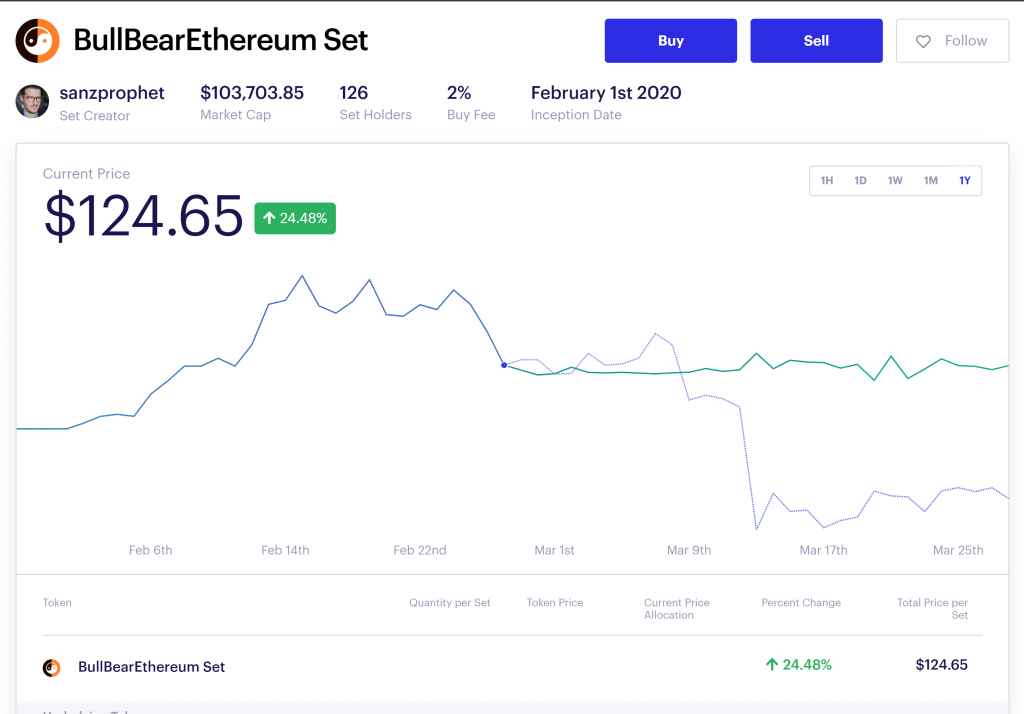

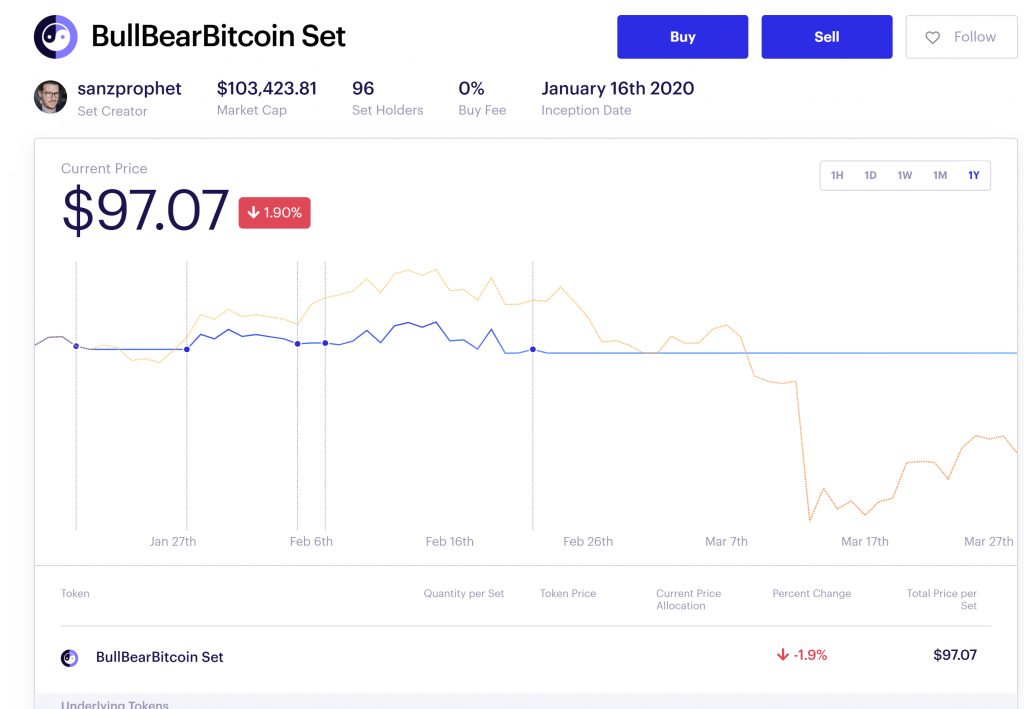

The BullBearEthereum Set (BBE) is currently the best performing Set since inception while the BullBearBitcoin Set (BBB) stayed almost flat and is the best performing set that invests in Bitcoin

Both BB Sets were live during the end of a small bull cycle that led into the coronavirus crash. This was an extreme reality test as the crash was a rare ‘black swan’ event. BBE went to cash as well as managed to keep 25% profit from the previous bull cycle.

The BBB strategy drawdown was a mere -7.8% (vs -55+% for Bitcoin).

The new structure: Buy, Streaming and performance fees

Buy fee

A buy fee is a fee paid for someone to enter a Set. It is a good compensation for a manager but used alone, it gives the wrong incentives since there is no reason to service existing investors once they enter and the fee is collected.

Streaming fee

A streaming fee is an annual fee on money in the fund (assets under management or AUM) used to compensate the manager. In my opinion this fee gives the best incentives to a manager to create a well performing strategy. At 1.5% it is calculated like this: For $100,000 managed, the fee is 100,000 x 1.5 /100 = $1500 per year. Or $125/month.

This is compensation to monitor markets, manage rebalances, communicate to subscribers and answer questions. The streaming fee gives the incentive to the manager to grow AUM (assets under management). This means bring new people in but also keep existing investors happy (i.e. not ‘burn’ them). This is different from the buy-in fee that incentivizes managers to just keep bringing new people by burning old strategies and creating and marketing new ones.

Performance fee

A performance fee is a fee on extra performance. If BBE’s highest price has been $125, that is set as the ‘high watermark’. If BBE goes to $130, the manager makes 15% of the extra profits . If the strategy never goes beyond $125, the manager makes zero.

Although performance fees sound fair at first, the do twist incentives for the manager. They incentivize to take on more risk than normal. Why?

By taking more risk the manager can augment possible profits or possible losses. The manager participates only on the extra profits but not on the extra losses. So a manager solely on performance fees will try ‘leverage’ positions and take unnecessary risk. If it works out they make more money. If it does not work out they do not loose more, the client does. The way to fix this is to add a streaming fee so that there is an incentive to keep existing investors from getting burned (ie loosing too much) and pulling funds from the fund (which decreases AUM).

The best incentives are given by a combination of the streaming and performance fees.

Leave a Reply