The Bull Bear Bitcoin Set has been running live at TokenSets since January 16, 2020. After 4 re-balances there is a clearer picture of the slippage expected, which is in the 0.6% – 0.8% area. This slippage is expected to fall in 0.3-0.5% range once more resources are brought in. Until then and based on realistic slippage, the strategy parameters will change so that the strategy remains viable. In summary the strategy will become less ‘trigger happy’ on exits, hence it will exit and re-enter less often.

These adjustments increase the drawdown (risk) but also increase the potential profit in bull runs. They also make the strategy less sensitive to slippage costs.

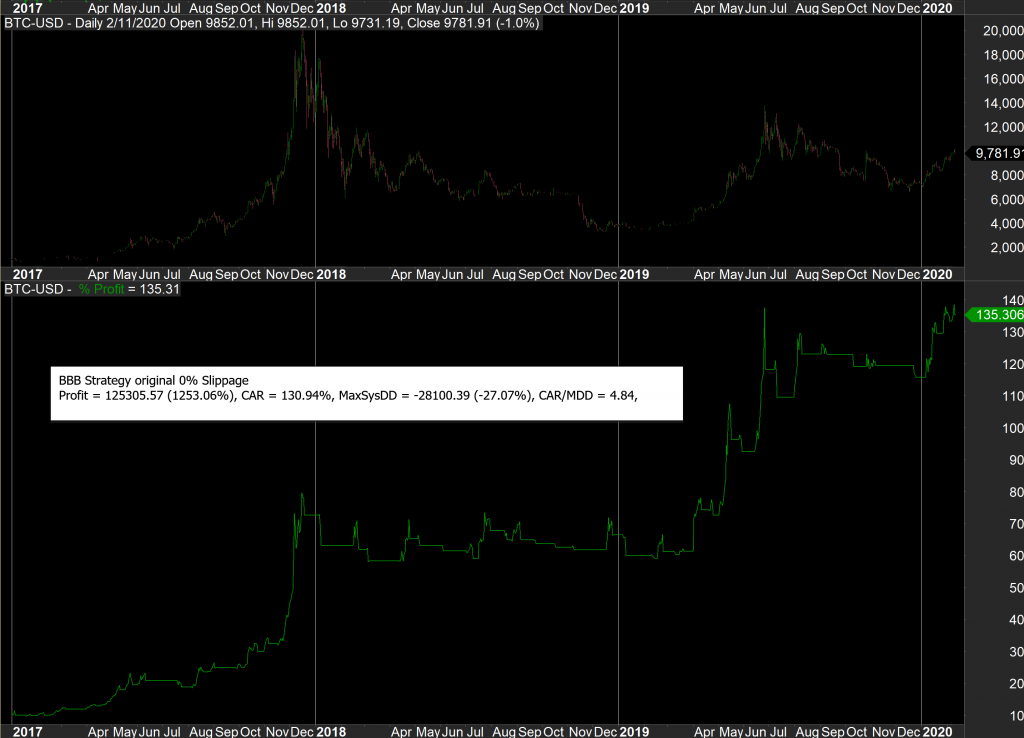

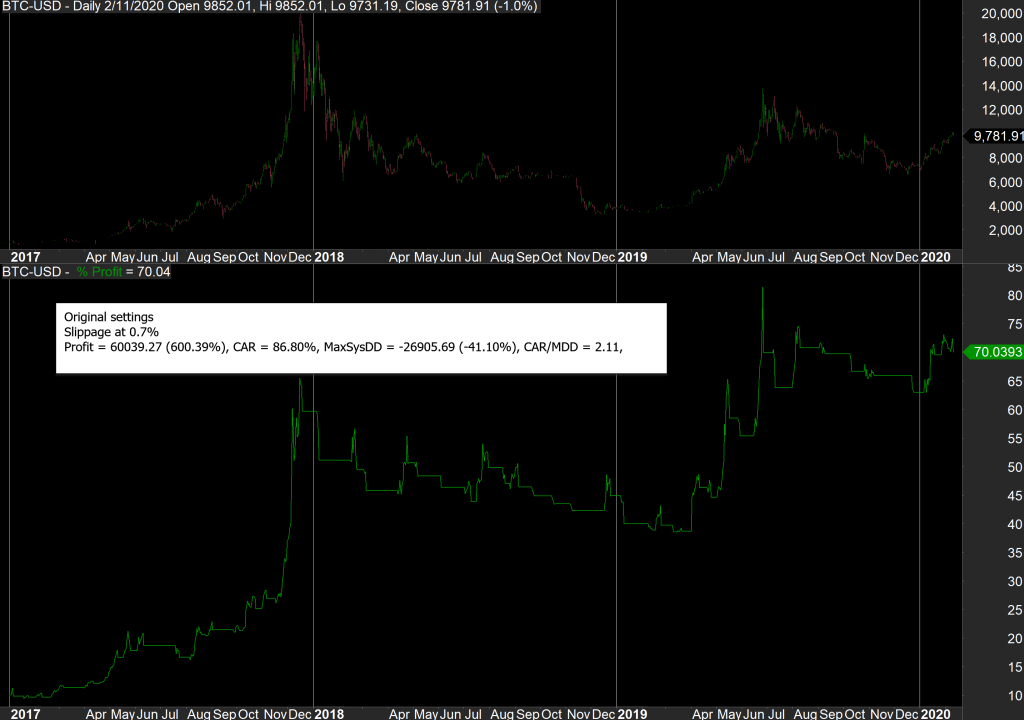

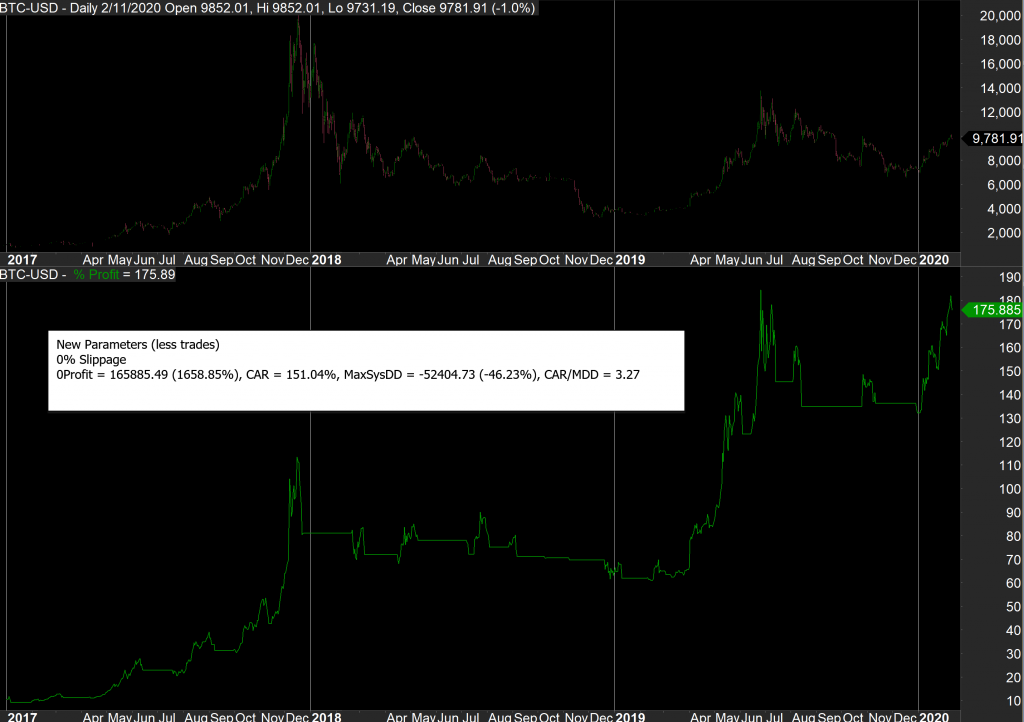

Below you can see the charts of 4 backtests:

- Original parameters – Assuming 0% Slippage

Profit = 125305.57 (1253.06%), CAR = 130.94%, MaxSysDD = -28100.39 (-27.07%), CAR/MDD = 4.84 ,

- Original parameters – Assuming 0.7% Slippage

Profit = 60039.27 (600.39%), CAR = 86.80%, MaxSysDD = -26905.69 (-41.10%), CAR/MDD = 2.11,

- New parameters – Assuming 0% Slippage

Profit = 165885.49 (1658.85%), CAR = 151.04%, MaxSysDD = -52404.73 (-46.23%), CAR/MDD = 3.27

- New parameters – Assuming 0.7% Slippage

Profit = 120912.74 (1209.13%), CAR = 128.34%, MaxSysDD = -54888.37 (-52.79%), CAR/MDD = 2.43

As a note: The BBE Set (+24% month-to-date) does not need an adjustment since it has smaller slippage (the ETH-DAI pair is very liquid), the strategy trades less often and the ETH % moves are larger so they are less affected by adverse slippage.

The original whitepaper for the Bull Bear Bitcoin strategy is here.

Leave a Reply