In order to analyze and build ‘crypto’ based trading strategies we need to get historical data for Bitcoin and other ‘large-cap’ coins such as Ether, Ripple, Dash, Monero, etc. But also for up and coming coins such as Neo, Stratis, IOTA and many more. In this post I will point you to two solutions:

1. Using simple Python scripts originally posted by QuantAtRisk.com

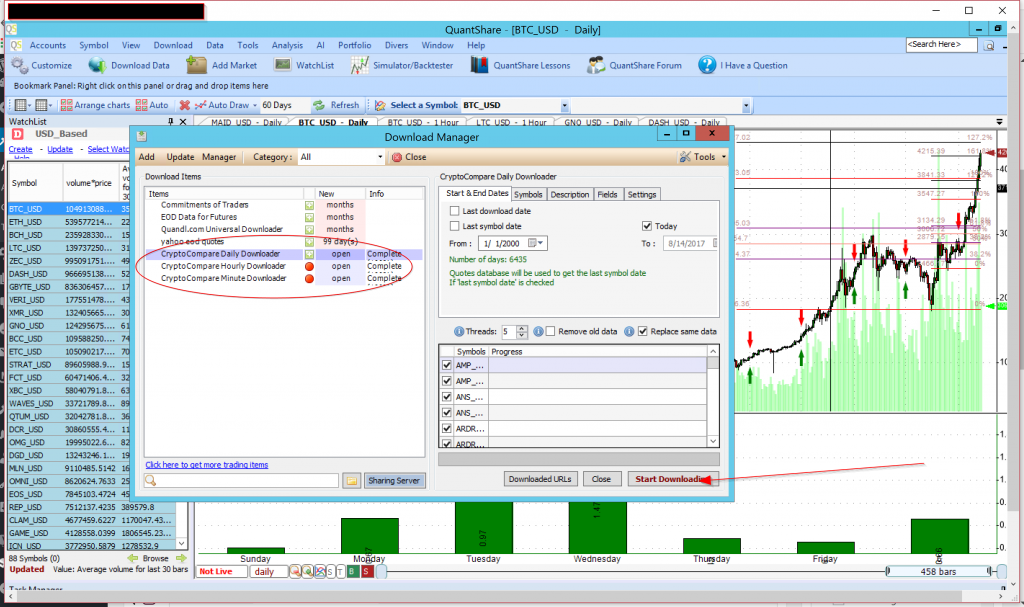

2. Using QuantShare software and a ready-made downloader.

1. Python scripts:

Get the latest list of cryptocurrencies, sorted by market capitalization from Coinmarketcap.com

Get Daily prices from Cryptocompare.com.

To get intraday data you can take a look at the Crytocompare API and adapt this script.

The last script will create one csv file for each coin. You can then import these files into your own software.

2. Using QuantShare.

I actually use QuantShare for analysis and backtesting and wrote a Cryptocompare downloader for it. If you have QS the downloader is free from QS’s online trading objects library.

great guide. thanks for sharing!