Investment software to easily create and backtest a rules-based investment strategy

QUANTtrader is a swiss-made software tool used to develop, backtest and implement rules-based strategies. It was initially developed by Frank Grossmann as his personal investment software. After having sold two companies, Frank trades for a living and his software reflects this. QuantTrader is available from Logical-Invest.com for a monthly license.

Since it is built by a trader and long-time investor rather than by a developer. QuantTrader’s main strength is in building medium to long term investment portfolios that are diverse, adaptive and can control risk. All this without writing a single line of code.

All Logical Invest trading strategies included

The investment software comes per-populated with all strategies currently run by Logical Invest. These are strategies that have been successfully running “live” for 1-3 years (this is written February 2017) so you can actually track past performance. You can customize, tweak existing or build your own strategies.

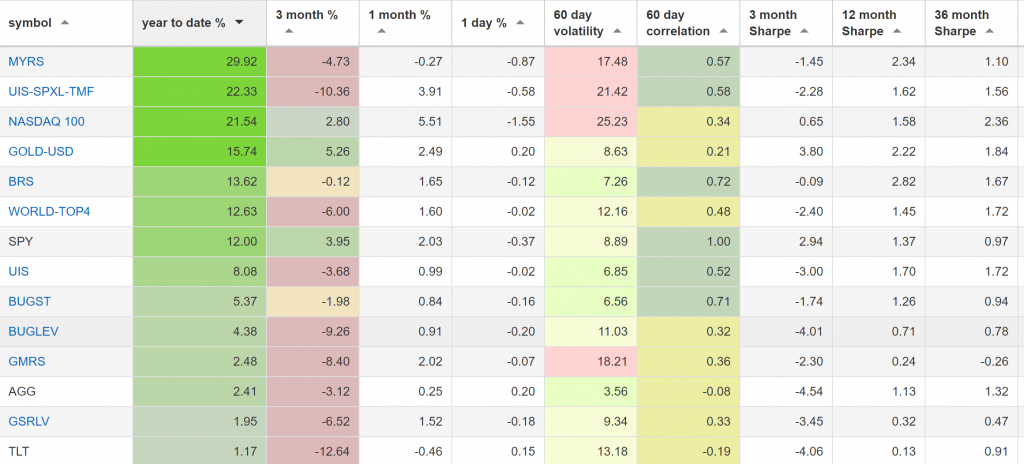

The following table shows the strategy returns for 2016 (under the “Year-To-Date” column), published at the Logical-Invest newsletter on January 2017.

A good fit for advisors and managers.

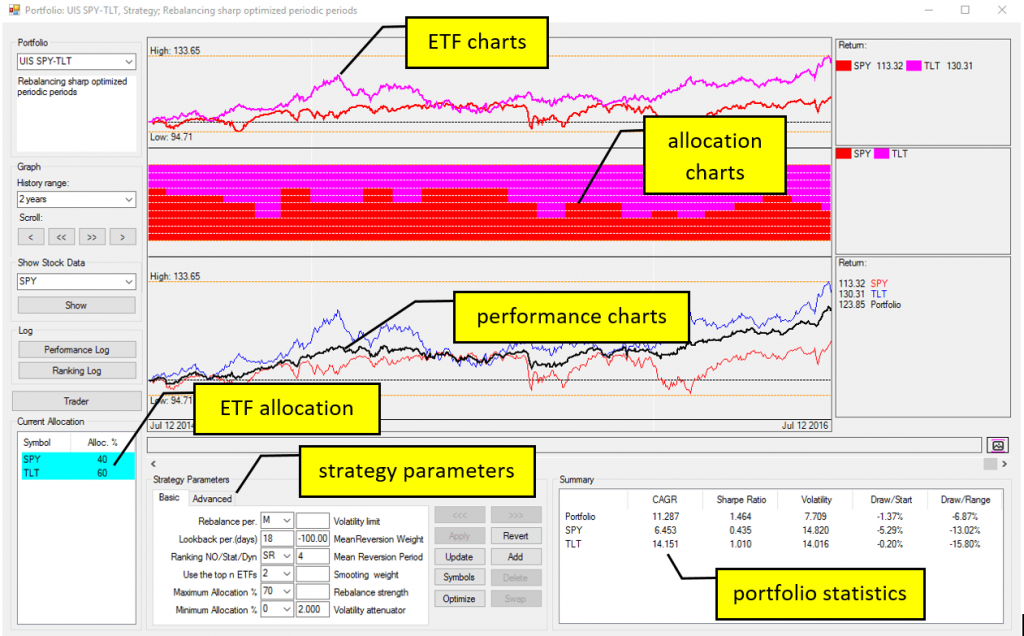

In many ways, QT is a good fit for advisors and portfolio managers. Given a client’s 401k account, the advisor can input a basket of available instruments (as long as these instruments are listed in Yahoo finance) and QuantTrader can create rules-based strategies and instantly show hypothetical past performance. These intelligent portfolios that are rules-based are easy to visualize and explain to a client and even easier to implement.

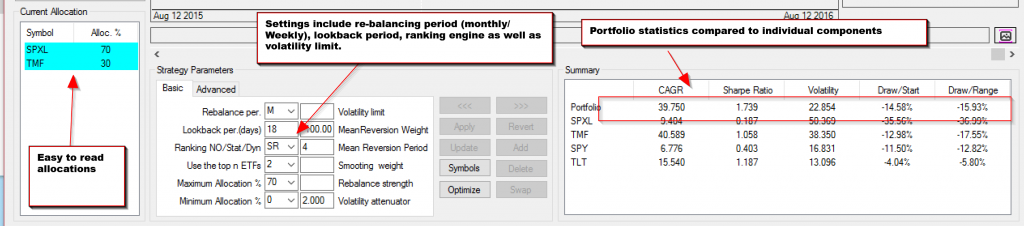

The algorithms behind QuantTrader are rotational in nature. By analyzing performance, volatility and cross-correlations of the assets in the initial basket, QT can pick the top X assets each month that performed best, were less volatile, were least correlated or a combination of the above. For the quants in the room, QT can create a minimum volatility allocation portfolio, a max-sharpe allocation, a pure momentum allocation and everything in-between. There are ways to manage volatility risk as well as mix momentum and mean reversion criteria.

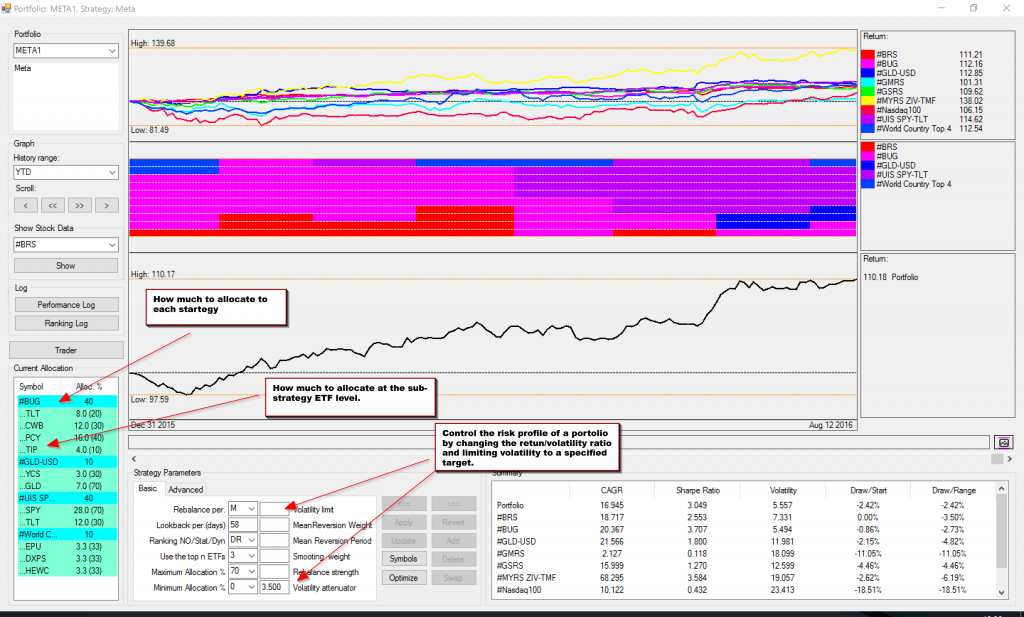

Easily allocate across multiple strategies

The amazing simplicity and strength of QuantTrader comes in it’s ability to create “Meta-Strategies”. Those are strategies of strategies. So if a user creates momentumA, reversionB and minVolatilityC strategies, these become available as “ETFs”. So one can load them as the initial assets and run a new strategy that it will allocate across the three strategies every month. For example 10% momentumA, 30% reversionB and 60%minVolatilityC.

QuantTrader is pricey at a minimum of $150/month for individuals and ranges from $500-$750/month for Advisors depending on their AUM. The price reflects the fact that all Logical Invest strategies are embedded and can be traded “as is” in minutes.

Conclusion

Having tried different backtesting software, this one if for active portfolio managers not quants. It is simple, easy to understand and has an asset allocation logic rather than a buy/sell logic. It fits best for professionals that need to test, justify and communicate allocations with clients as well as individuals with large accounts that need to “diagonally” diversify across both assets and strategies while keeping it all easy and manageable.

To see QT in action, you can watch this extensive recorded webinar explaining the basics.

You can find more info at Logical-Invest’s QuantTrader page and on this article.

Disclaimer: I am a partner at Logical Invest, so assume I am positively biased!

I want to back test selling and buying one ETF on different days going back a number of years and get a report. Is there a fee service to do that.

There are software (amibroker, quantshare, etc) that you could use to create such a report. If you want something custom made send me an email explaining what you are looking for.