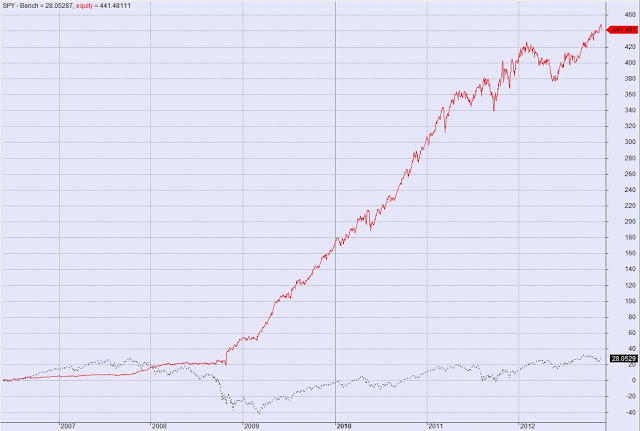

Here’s the Equity curve:

And here’s the code:

Buy=Sell=Short=Cover=0;

if (StrFind(“WOODGDXEPUIDXPALLJJG”, Name()))

Buy=Sell=1;

qty=6; SetOption(“MaxOpenPositions”,qty);;

SetOption(“MaxOpenPositions”,qty);;

PositionSize=-98/qty;

SetTradeDelays(0,1,1,1);

BuyPrice=C;

SellPrice=O;

ShortPrice=O;

CoverPrice=C;

What’s happening here?

This is a variation of Jay Kaeppel’s post at optionetics but using some extra ETFs that have exhibited the same kind of behavior. Original article: http://www.optionetics.com/market/articles/2012/11/28/kaeppels-corner-the-greatest-gold-stock-system-youll-probably-never-use

It buys equal amounts of each of these 6 etfs: WOOD,GDX,EPU,IDX,PALL,JJG.

It buys on the close of the U.S.session, holds overnight and sells on the open the next day.

Would you invest in this strategy?

A variation of:

http://www.optionetics.com/market/articles/2012/11/28/kaeppels-corner-the-greatest-gold-stock-system-youll-probably-never-use

?

Exactly right! This is a variation of Jay Kaeppel's post at optionetics but using some extra ETFs that have exhibited the same kind of behavior. Original article: http://www.optionetics.com/market/articles/2012/11/28/kaeppels-corner-the-greatest-gold-stock-system-youll-probably-never-use

This might be too correlated with GDX but I think SIL works too