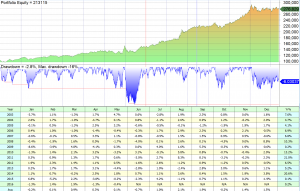

In this post we will: Take a look at a simple, momentum based, monthly rebalanced Equity/Bond portfolio consisting of two ETFs: SPY and TLT. Search for what has been the optimal dates in the month to rebalance such a portfolio. Each month we allocate to SPY and TLT. If SPY has outperformed TLT we rebalance …

DYI Investing, Quant tools and thoughts on the market