There are certain advantages to running a ‘digital-only’ fund at tokensets.com. One is transparency. When you buy a Set, like the BBB Set, the transaction is logged into the Ethereum blockchain, which is a public ledger . This results in easy access to the latest fund AUM, distribution of holders and various other statistics, identified …

The Bull Bear Bitcoin Strategy at TokenSets.com

+ I will be managing the Bull Bear Bitcoin Set (symbol: BBB) . Much like an actively managed ETF, it switches between Bitcoin and Cash. There are currently zero (0%) fees*. It is ‘non-custodial’, so you own the actual underlying assets . How to follow the strategy/ buy a SET? Visit the Bull Bear Bitcoin …

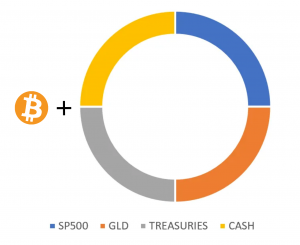

Bitcoin plus Harry Brown’s Permanent Portfolio – A mix in heaven?

What would happen if you took $5,000 out of your $100,000 permanent portfolio and allocated it to Bitcoin? From 3.6% annual to 15% annual returns? Got to love the Permanent Portfolio I have been somewhat obsessed with the simplicity and fundamental thinking behind the permanent portfolio. I have written and analyzed it various times (here …

Read moreBitcoin plus Harry Brown’s Permanent Portfolio – A mix in heaven?

Enhancing Harry Browne’s Permanent Portfolio strategy

First published at Logical-Invest.com What is the Permanent Portfolio by Harry Browne Harry Browne’s intention was to find a solution for the money “you need to take care of you for the rest of your life”. He called it the Permanent Portfolio because he believed that once an investor sets it up, they never have …

Read moreEnhancing Harry Browne’s Permanent Portfolio strategy

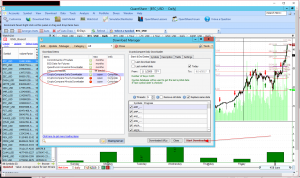

Bitcoin, Ethereum and Altcoins: How to get free daily and intraday Bitcoin historical prices

In order to analyze and build ‘crypto’ based trading strategies we need to get historical data for Bitcoin and other ‘large-cap’ coins such as Ether, Ripple, Dash, Monero, etc. But also for up and coming coins such as Neo, Stratis, IOTA and many more. In this post I will point you to two solutions: 1. Using …