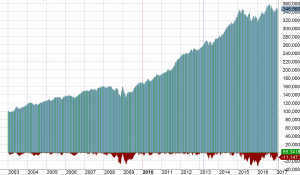

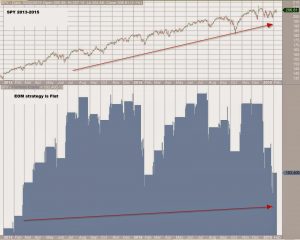

1. Basics What is rules based Investing? In rules-based-investing we define a clear set of rules. These rules comprise an investment strategy. Here is an example strategy: “At the first day of the month, look at the performance of bonds versus stocks by calulating the 3-month performances of two exchange traded funds, SPY (the SPDR …

Read moreIntro to rules based Investing – Why follow an investment strategy?