Review of the BullBear Bitcoin and Ethereum crypto funds (Sets) 2020

strategy

Changes to the Bull Bear Bitcoin Strategy

The Bull Bear Bitcoin Set has been running live at TokenSets since January 16, 2020. After 4 re-balances there is a clearer picture of the slippage expected, which is in the 0.6% – 0.8% area. This slippage is expected to fall in 0.3-0.5% range once more resources are brought in. Until then and based on …

The Bull Bear Ethereum Set at TokenSets.com

+ Strategy in a coin The Bull Bear Ethereum Set (symbol: BBE) is a strategy-in-a-coin. Instead of implementing the strategy, outlined here, you can purchase the SET, which is a standard ERC20 coin you get to keep in your wallet. Please read the strategy Whitepaper 8.82% APY on idle cash (using cDAI) When the strategy …

The Bull Bear Bitcoin Strategy at TokenSets.com

+ I will be managing the Bull Bear Bitcoin Set (symbol: BBB) . Much like an actively managed ETF, it switches between Bitcoin and Cash. There are currently zero (0%) fees*. It is ‘non-custodial’, so you own the actual underlying assets . How to follow the strategy/ buy a SET? Visit the Bull Bear Bitcoin …

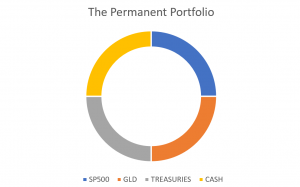

Enhancing Harry Browne’s Permanent Portfolio strategy

First published at Logical-Invest.com What is the Permanent Portfolio by Harry Browne Harry Browne’s intention was to find a solution for the money “you need to take care of you for the rest of your life”. He called it the Permanent Portfolio because he believed that once an investor sets it up, they never have …

Read moreEnhancing Harry Browne’s Permanent Portfolio strategy