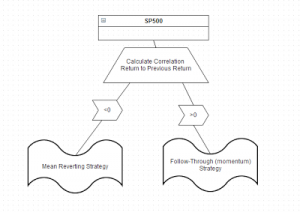

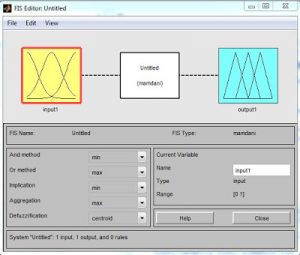

In the previous post I showed how one can implement “regime” switching to create a strategy that switches between a mean-reverting and a momentum sub-strategy. Can we do something similar (or better) using Fuzzy Logic? Here’s the setup: (here for some Fuzzy Logic backround) We create a basic membership function for the RSI(2) indicator: …

fuzzy logic

Trading with Fuzzy Logic

The case for Fuzzy Logic in Trading The more I backtest strategies the more I feel the need for robustness in a system. There is no point to optimize return. One should optimize certainty of positive return. Most strategies that do really well in the past are over complicated and over-fitted and tend to loose money. One …