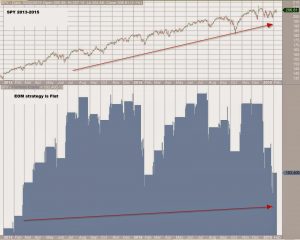

Has the end of month strategy stopped working? Historically and up to 2013, equities have exhibited a positive bias during the end of the month. Here is an example of buying the SPY etf on the first down-day after the 23rd and selling on the first up-day of the next month. Trading is at the same day …

code

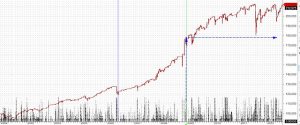

Quiz System

Here’s the Equity curve: And here’s the code: Buy=Sell=Short=Cover=0;if (StrFind(“WOODGDXEPUIDXPALLJJG”, Name()))Buy=Sell=1;qty=6;SetOption(“MaxOpenPositions”,qty);;PositionSize=-98/qty;SetTradeDelays(0,1,1,1);BuyPrice=C;SellPrice=O;ShortPrice=O;CoverPrice=C; What’s happening here? This is a variation of Jay Kaeppel’s post at optionetics but using some extra ETFs that have exhibited the same kind of behavior. Original article: http://www.optionetics.com/market/articles/2012/11/28/kaeppels-corner-the-greatest-gold-stock-system-youll-probably-never-use It buys equal amounts of each of these 6 etfs: WOOD,GDX,EPU,IDX,PALL,JJG.It buys on the close …

7 Winning Trading Systems Reviewed – 3 Day High/Low

Back in 2009 Larry Connors and Cesar Alvarez published several short term trading systems in their book “High Probability ETF Trading”. They described 7 mean reverting strategies. What happens, then once a strategy becomes public domain? Do they loose their edge?All tests are performed on a set of 20 ETFs:DIA,EEM,EFA,EWH,EWJ,EWT,EWZ,FXI,GLD,ILF,IWM,IYR,QQQQ,SPY,XHB,XLB,XLE,XLF,XLI,XLVTthe strategy can hold up to 10 ETFs …

Read more7 Winning Trading Systems Reviewed – 3 Day High/Low