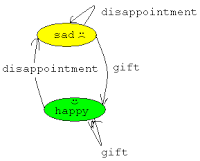

No, it’s not french and it’s not the movie.It’s a fast-N-rough “Adaptive Multi strategy Multi Instrument” model. Let’s assume we want to trade mean-reversion: If price moves down we buy, if it moves up we sell. Possible Indicators from the blog-o-sphere:RSI(2),RSI(3),RSI(4)DV2 here and hereBSI here or hereBoilingerBandsCRSI hereTD9 here Question 1: Which Indicator to use? One …

adaptive

Better than mean-reversion? An Adaptive Multi-Strategy System

Mean reversion strategies have been very popular since 2009. They have performed exceptionally well for the past 10 years, performing well even during the 2008-09 bear market. Different versions have been popularized, notably by Larry Connors and Cezar Alvarez (previous post) as well as many others in the blog-o-spere such as David Varadi of CSS analytics (DV2) and Michael Stokes @ MarketSci. …

Read moreBetter than mean-reversion? An Adaptive Multi-Strategy System