In order to analyze and build ‘crypto’ based trading strategies we need to get historical data for Bitcoin and other ‘large-cap’ coins such as Ether, Ripple, Dash, Monero, etc. But also for up and coming coins such as Neo, Stratis, IOTA and many more. In this post I will point you to two solutions: 1. Using …

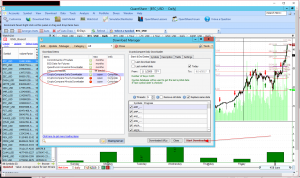

QuantShare

Backtest Multiple Strategies

If you are serious about trading and/or investing and are willing to commit a good amount of your net worth, you may choose not to follow just one strategy. You may be better off splitting your capital amongst not just different asset classes or stocks or etfs but also different strategies that trade those assets. How can …

Quantshare Trading Software on Amazon’s EC2

I wrote an article on how to automate the process of updating quotes, updating multiple trading strategies and e-mailing next day signals form the cloud to our own e-mail boxes. This time I am using QuantShare as the trading software and an Amazon EC2 micro instance as the host cloud. You can read the article …