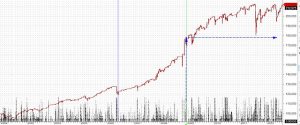

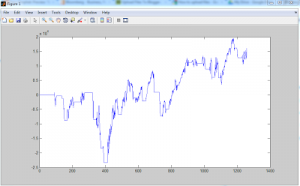

Back in 2009 Larry Connors and Cesar Alvarez published several short term trading systems in their book “High Probability ETF Trading”. They described 7 mean reverting strategies. What happens, then once a strategy becomes public domain? Do they loose their edge?All tests are performed on a set of 20 ETFs:DIA,EEM,EFA,EWH,EWJ,EWT,EWZ,FXI,GLD,ILF,IWM,IYR,QQQQ,SPY,XHB,XLB,XLE,XLF,XLI,XLVTthe strategy can hold up to 10 ETFs …

Read more7 Winning Trading Systems Reviewed – 3 Day High/Low