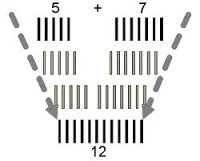

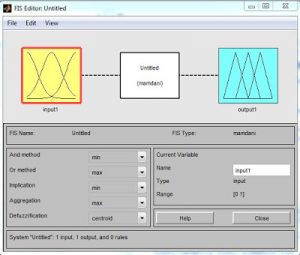

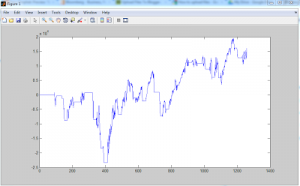

Fuzzy Logic pt.3: Auto-generate model parameters I often tire of reading these complicated academic papers that are filled with impossible jargon only to make my life harder. I have found that often times the difficult terminology only hides the simple concepts that lie behind. So here I will use a difficult term myself, just to sound smarter …

Read moreFuzzy Logic Optimization -The “WOO-FOO-SMASH-EFIS-MEE-COPT” model