In order to analyze and build ‘crypto’ based trading strategies we need to get historical data for Bitcoin and other ‘large-cap’ coins such as Ether, Ripple, Dash, Monero, etc. But also for up and coming coins such as Neo, Stratis, IOTA and many more. In this post I will point you to two solutions: 1. Using …

trading software

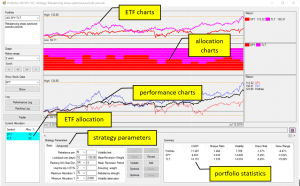

QUANTtrader -The Logical-Invest investment software for building and backtesting rules-based strategies

Investment software to easily create and backtest a rules-based investment strategy QUANTtrader is a swiss-made software tool used to develop, backtest and implement rules-based strategies. It was initially developed by Frank Grossmann as his personal investment software. After having sold two companies, Frank trades for a living and his software reflects this. QuantTrader is available from Logical-Invest.com …

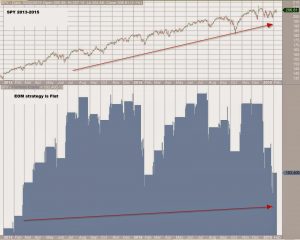

The end of the end of month strategy

Has the end of month strategy stopped working? Historically and up to 2013, equities have exhibited a positive bias during the end of the month. Here is an example of buying the SPY etf on the first down-day after the 23rd and selling on the first up-day of the next month. Trading is at the same day …

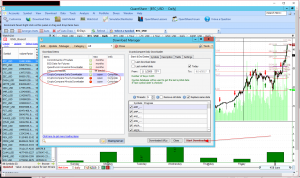

CBA – Quick test drive

Inspiration strategy: http://empiritrage.com/2013/01/21/correlation-based-allocation/ Quoted from Empiritrage.com:“We propose a model that is designed to identify bull-market and bear-market regimes. We examine correlation between stocks and bonds as a signal. Our hypothesis is that negative correlation between long bonds and stocks represents a bear-market regime, and a positive, or non-existent correlation, reflects a bull market regime.The model calculates …

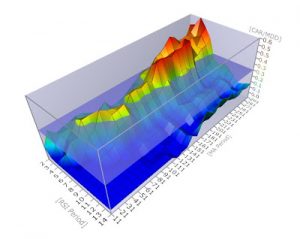

Visualizing Data

I have been looking for ways to visualize what happens to a trading system when we shift it’s parameters. I bumped into this little free tool that might help us do that. Let’s start from the beginning: We will start with a hypothetical mean reversion system and check visually what happens as the parameters change.We …