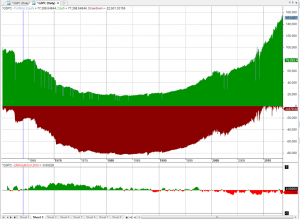

image from http://brucekrasting.com/ Let us consider two possible ways to trade the SP500. 1. If the index falls today, we buy tomorrow at the open. This is a “mean-reversion” strategy. 2. If the index rises today, we buy tomorrow at the open. A “follow-through” strategy. From the graphs below, we can see that neither of …

ETF / Stocks

Selling Puts on Breakouts

If someone asked you to sell Puts on the SP500 and hold to expiration, when would you sell them? On a correction or a bullish breakout? This is a strategy that I came about by accident. I actually meant to do the exact opposite of what I ended up testing… I can’t say I would trade this …

Backtesting Options: Selling SPY Puts on RSI(2)

Let’s try the good old strategy for RSI(2) mean reversion.Buy on Rsi(2)<30Sell on Rsi(2)>60Execution is on the Open of the next day.This is what trading the SPY etf looks like. How about using the same signals and selling 10, 1-point away from the floor price, front month Puts.* Again, we sell 10 Puts right below …

CBA – Quick test drive

Inspiration strategy: http://empiritrage.com/2013/01/21/correlation-based-allocation/ Quoted from Empiritrage.com:“We propose a model that is designed to identify bull-market and bear-market regimes. We examine correlation between stocks and bonds as a signal. Our hypothesis is that negative correlation between long bonds and stocks represents a bear-market regime, and a positive, or non-existent correlation, reflects a bull market regime.The model calculates …

Seasonals – SP500, Euro

Here’s the strategy: Each month we buy at the Open of the first day of the month and sell at the close of the last day of the month. Here’s the average profit loss for the S&P500 Etfs, SPY (yahoo:SPY). Data from 1993. This chart shows that for example if we bought every December @ …