Lessons from 2 Crypto Bull markets

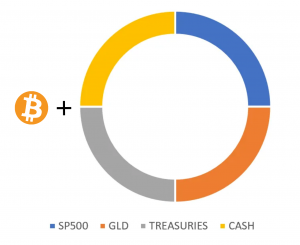

Revisiting Bitcoin plus Harry Brown’s Permanent Portfolio – 2 Years later @ 40% profit

On January 2020 I posted a proposal for combining the Permanent Portfolio with a small 5% allocation to Bitcoin. The main argument was that by risking 5% of the portfolio we could almost double returns. What would happen if you took $5,000 out of your $100,000 permanent portfolio and allocated it to Bitcoin? From 3.6% …

Read moreRevisiting Bitcoin plus Harry Brown’s Permanent Portfolio – 2 Years later @ 40% profit

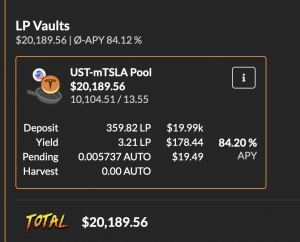

How to invest in Tesla (TSLA) and receive 6% interest a month (84% per year)

Thanks to the wonderful world of cryptocurrencies, Decentralized Finance (DeFi) and Mirror finance this is possible, at least at the time of writing. Goal Deploy $20,000 in capital and target an income of $1000 per month. Using the UST and mTSLA pool Although it is possible to do this in the Terra or the Ethereum …

Read moreHow to invest in Tesla (TSLA) and receive 6% interest a month (84% per year)

BullBear Ethereum Strategy performance – Jan 2020 to March 2021

These are the real performance stats of the BBE TokenSet, based on the BullBear Ethereum strategy, that went live on January 2020 up to March 19, 2021. The TokenSet has now been suspended due to high Ethereum fees. Tearsheet (generated by QuantStats) BullBearEthereum (BBE) Set Tearsheet 1 Feb, 2020 – 21 Mar, 2021 Generated by …

Read moreBullBear Ethereum Strategy performance – Jan 2020 to March 2021

BullBear Bitcoin Strategy performance – Jan 2020 to March 2021

These are the real performance stats of the BBB TokenSet, based on the BullBear Bitcoin strategy, that went live on January 2020 up to March 19, 2021. The TokenSet has now been suspended due to high Ethereum fees. Tearsheet (generated by QuantStats) BullBearBitcoin (BBB) Set Tearsheet 17 Jan, 2020 – 19 Mar, 2021 Generated by …

Read moreBullBear Bitcoin Strategy performance – Jan 2020 to March 2021