If someone asked you to sell Puts on the SP500 and hold to expiration, when would you sell them? On a correction or a bullish breakout?

If someone asked you to sell Puts on the SP500 and hold to expiration, when would you sell them? On a correction or a bullish breakout?This is a strategy that I came about by accident. I actually meant to do the exact opposite of what I ended up testing… I can’t say I would trade this as-is but there are some lessons to be learned here, at least for me.

The rules:

When SPY makes a new 15-day high, sell a next-month out-of-the-money PUT.

Pick the farthest strike whose corresponding option price is larger than $0.60.

So if SPY trades at 140, we would try selling the 125 strike. If it’s priced at $0.10, we check a higher strike, i.e.,126, 127,128… until we get to a strike whose option price equals or is greater than $0.60.

If the option looses more than 30% of it’s value at the close of the day (not intraday), we sell it on the next day at the close.

Otherwise hold to expiration.

Just to get some context:

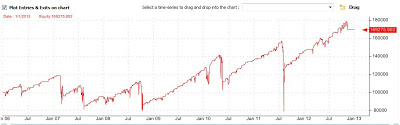

You need to contrast the above chart to the typical Put-selling strategy. High win ratios (i.e., winners > 80% of the time) but when we have loosers, they are usually huge ones.

Thoughts and Conclusion:

Having tried different versions of strategies that sell naked options, I can say that I would recommend against it. And if you must, please try to somehow backtest the strategy first.

My results have been mediocre at best. The risk of being short an option is just too massive. One loss may cripple months of winning. Stops may help but they tend to level the winning ratio and often cause multi-year flat equity curves.

Another conclusion is that complex option strategies can be thought of as multi-strategy (MS) systems. In other words, a Buy-Write strategy, where one buys SPY and sells a call against it is nothing more than:

Strategy 1: A (very simple) long only SPY stock strategy.

Strategy 2. A (very simple) short only call strategy.

Similarly, an Iron Condor is a simplified 4 strategy MS system.

All this is still work in progress as other factors like early exercise are being looked at.

What is interesting about the above strategy is that :

1. It’s not intuitive (to me at least) that one would sell Puts on Bullish Breakouts*.

2. It limits draw-downs by not triggering unless we have a breakout on the long side. So if the market falls and keeps falling, this strategy stays flat.

3. A 30% stop on the option is a very tight stop. It means that even a small move against us will immediately trigger an exit. On the other hand, by exiting on the next day close, we take advantage of mean-reversion. So if a 1% move down of SPY triggers the exit, chances are the next day will be an up day and we would sell (cover actually) at this up day’s close.

—————————————————————————————–

*This is counter-intuitive since a bullish breakout would imply a collapse of implied volatility premium on the option to be sold. It’s a proposition to sell on low premiums. Intuitively one would sell on bearish breakouts, where implied volatility surges causing the put to be more expensive (and us collecting a higher premium).

Where did you get the option data to backtest this strategy?

The reason it works is because options almost always charge more to those who are buying them (supply/demand problem behind the scenes). So you typically get some extra IV to sell even when IV is "low".

I have a friend who sells options 90% of the time, precisely for this reason. Yeah, you could get screwed if you're naked, but you should probably be hedging your positions in some manner to avoid that.

@IV

That may be true (the premium). I tried this strategy on the straight SPY etf (not the option) and it doesn't work as well.

@anonymous:

The data I used originates from OPRA. Here's a threat about options data:

http://www.elitetrader.com/vb/showthread.php?s=&threadid=252951&perpage=6&highlight=option%20purchase&pagenumber=1

Interesting idea. How much capital did you allocate to each trade and was it calculated on a 'cash secured' basis (ie: [option strike – option price] * 100)?

Also, do you recalculate the stop price each day or is it always based on the original $0.6 entry?

The cool thing about this strat is that it exploits two alpha generating quirks in the market: momentum and the volatility risk premium.

Very interesting way to look at it.

As for position sizing, I used

contracts=Equity*PercentRisked/priceofPut. Where PercentRisked=3.

In other words the backtests starts with an 100,000 equity (cash), sells $3,000 worth of puts and then keeps selling 0.03*Equity dollars worth of puts. How would positions be calculated using "cash secured basis"?

The stop is constant throughout and set at purchase price -30% of purchase price. So if a put is sold @ $1.00, if at any point the closing (not intraday) price ended up below 0.7, the put would be bought back at the next day close.

Thanks for this. I just sent you an email so I wouldn't monopolize your comment stream too much. =)

@SP it's not the premium, per se. You always get a premium (that is the money you get for selling the option), it's just you tend to get more than you should theoretically when selling. This is because of supply and demand. It's hard for me to put it into words…lol. Kinda nuanced and still not without it's problems.

Sanz, I think you are getting the combined benefits of option selling with the protection of a new index high. Check how many times the market crashed from a high (there are too many bids to allow it).

I did run two backtests on SPY (not options). One buys SPY on a break of the 15-period high. The other buys SPY on a break of the 15-period low. Even though the second strategy performs better than the first, it does experience larger draw-downs. So it must be those larger draw-downs that hurt the system when "translated" into selling puts. It is known that the most volatile returns in SPY tend to happens when SPY is below it's 200-day average (M. Faber, http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1908469).

On the other hand buying SPY on bullish breakouts is a flat to negative biased strategy that seems to turn positive (with the addition of a tight stop-loss) when applied to selling Puts. My take on this is that these results depend more on how leverage and volatility (or max -drawdowns) interact on compound profit systems rather on just timing.

This is an interesting subject for a future post.

Time decay also helps the strategy, but options buyers are not giving away free money!

I posted a couple of supporting histograms on my blog: http://rrspstrategy.wordpress.com/2013/05/14/selling-puts-on-breakouts-sanz-prophet/

nice strategy! but what if the stock comes down? what is your strategy then? any protection?

wild dreams

There's a fairly tight stop-loss in the strategy.