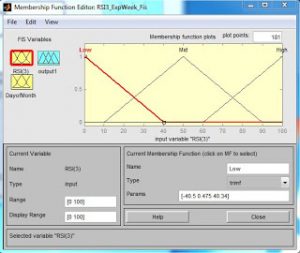

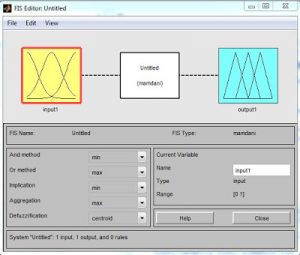

In the previous posts (pt1, pt.2, pt.3) we talked a bit about how to take various indicators and fuzzify them. Now I will show how we can quickly test for relationships in indicators.So the question is: Can we only use RSI(3) and RSI(14) (short term and medium term Relative Strength Index) to trade the S&P500?So …

Read moreUncover Hidden Market Relationships Using Fuzzy Logic